Maine Sales Tax & Audit Guide

Straightforward Answers to Your Maine Sales Tax Questions.

- Do I need to collect Maine sales tax?

- Should I be collecting or paying Maine use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Maine.

Who Needs to Collect Maine Sales and Use Tax?

Like most states, to be subject to Maine sales tax collection and its rules, your business must:

1) Have nexus with Maine, and

2) Sell or use something subject to Maine sales tax.

How is Nexus Established in Maine?

According to the Maine Revenue Services, any retailer doing business in Maine must be licensed for sales tax collection. You're doing business in Maine if you or your company or your related company:

1. Anyone who sells tangible personal property or taxable services, whether wholesale or retail and maintains any business location in Maine.

2. Anyone who sells tangible personal property or taxable services with a substantial physical presence in this State

3. Any seller of tangible personal property or taxable services without a business location in Maine but who makes retail sales in Maine or solicits orders

through any representative in the State.

4. Any agent located outside of Maine that makes sales of tangible personal property or taxable services in Maine or receives compensation from sales of tangible personal property or taxable services for use in Maine made by a principal located outside of Maine or whose principal has a substantial physical presence in the State, unless the principal is registered as a seller.

5. Every person who makes retail sales in the State of tangible personal property or taxable services on behalf of the property owner or provider of those services.

6. Every person who rents living quarters, including a cottage, condominium unit, or vacation home

in Maine.

7. Anyone who operates a transient rental platform and any room remarketer (including online travel companies and others who reserve, offer, collect, or receive any consideration for the living quarters in the State.

8. Any person who rents or leases automobiles, camper trailers, or motor homes in Maine.

9. Every person who makes consignment sales.

10. Every lessor that does not maintain a place of business in Maine but who is in the business of leasing tangible personal property in Maine and makes retail sales to purchasers from Maine.

Additionally, businesses that do not have a physical presence in Maine can establish economic nexus by exceeding the annual sales threshold covered in the next section.

Economic Nexus (Wayfair Law) and Internet Sales in Maine

Out-of-state retailers

Out-of-state retailers selling tangible personal property, products transferred electronically, or taxable services for delivery into the State of Maine are required to register in the same manner as a retailer that has a physical presence in this State if:

A. The person's gross sales from the delivery into this State of tangible personal property, products transferred electronically, or taxable services in the previous or current calendar year exceeds $100,000; or

B. The person sold tangible personal property, products transferred electronically, or taxable services for delivery into Maine in at least 200 separate transactions in the previous or current calendar year.

Marketplace facilitators

Marketplace facilitators without a physical presence in Maine are required to collect Maine sales tax once the combined total of their sales in Maine and their third-party sales in Maine exceeds $100,000 in the current or previous year. They must have separate seller permits for their sales in Maine and third-party sales.

See alsoGuidance for Remote Sellers.

Maine retailers

Retailers with a physical presence in Maine who also are marketplace facilitators must collect Maine sales tax on their third-party sales in Maine. They must have separate seller permits for their sales in Maine and third-party sales.

How is the $100,000 gross revenue threshold calculated?

A remote seller must register with MRS and collect and remit the sales tax on the remote seller's sales on the first day of the first month that begins at least thirty days after the remote seller exceeds the nexus-establishing threshold in Maine. Sale price is "the total amount of a retail sale valued in money, whether received in money or otherwise."

Which Sales are Subject to Maine Sales Tax?

General Transactions

If you have nexus in Maine, the next step is determining whether the products or services you sell are subject to Maine sales and use tax.

On page 2 of Maine’s Reference Guide to Sales and Use Tax Law: A tax is imposed on the value of all tangible personal property, including property transferred electronically, and taxable services sold at retail in the State.

The tax rate of 5.5% applies to the following:

- Tangible personal property.

- Products that are transferred electronically.

- Rental or lease of an automobile for longer than one year.

- Rental or lease of camper trailers or motor homes.

- Rental or lease of a pickup truck or van.

- Prepaid calling (not prepaid wireless, which is subject to service provider tax);

- Transmission and distribution of electricity; and

- Extended warranties on cars and trucks. The 8% rate applies to all sales of:

- Prepared food; and

- Alcoholic drinks sold from breweries, wineries, and distilleries licensed to sell alcoholic beverages for on-premises consumption.

- The 9% rate applies to:

- Rentals of living quarters in a hotel, rooming house, or tourist or trailer camp.

The 10% rate applies to rentals of:

- Automobiles on a short-term basis; Page 11

- A pickup truck or van with a gross vehicle weight of fewer than 26,000 pounds by a person primarily engaged in the business of renting vehicles; and

- Any loaner vehicle by a motor vehicle dealer, other than one provided to a motor vehicle dealer’s service customers under a manufacturer's or dealer’s warranty.

- Beginning October 1, 2020. A tax rate of 10% applies to sales of adult-use marijuana, adult-use marijuana products, if sold by a person to an individual who is not a qualifying patient, marijuana, and marijuana products

The rules seem simple, but many details make applying Maine’s tax rules to your business challenging. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Maine Sales and Use Tax:

Casual sales are exempt from sales tax in Maine. Generally, items sold to a person in the business of renting the items are exempt from tax because the tax will be collected by the person who is in the business of renting the items. These provisions were enacted to avoid taxing on the item's purchase and again on the rentals of the same item. Here are some examples:

- The sale of automobiles or core auto parts to a person engaged in the business of renting automobiles.

- The sale of video media or video equipment to a person in the business of renting video media and video equipment.

- The sale of cable or satellite television equipment to a person in the business of providing cable or satellite television services or satellite radio services.

- The sale of furniture, audio media, or audio equipment for rental under a rental-purchase agreement as defined in Title 9-A, section 11-105; to a person engaged in the business of renting furniture or audio media and audio equipment.

- The sale of loaner vehicles, automobile repair parts, and tangible personal property for resale is exempt from sales tax in Maine, except for resale as a casual sale.

- The sale of tangible personal property for resale in the form of tangible personal property to a retailer who possesses a resale certificate, except for resale as a casual sale.

You can learn about all of the specific types of sales that are exempt from sales tax under this rule on page 5 of Maine’s Reference Guide to Sales and Use Tax Law.

Other exempt items include:

- Single-use bag fees

- Tire disposal fees

- Rental by a hotel of a dining room, assembly room, or other areas not intended for use as living quarters is not taxable.

- Grocery staples and food stamp purchases

- Sales of medicines prescribed by a doctor, including refills.

- Prosthetic or orthotic devices

- Diabetic supplies

- Third-party payment of medical bills

- Advertising and promotional material delivered out of State

- Manufactured housing sales

- Railroad track materials

- Deliveries to purchasers outside of Maine

- Animal agricultural production and related supplies

- Watercraft sold to non-residents

- Residential utilities

More specific information about these exempt items can be found on pages 65 - 98 of Maine's Reference Guide to Sales and Use Tax Law.

Services

The following are subject to the Service Provider Tax at the rate of 6%:

- Cable and satellite television or radio services.

- Fabrication services.

- Rental of video media and video equipment.

- Furniture, audio media, and audio equipment under a rental-purchase agreement as defined in Title 9-A, section 11-105.

- Telecommunications services.

- Telecommunications equipment installation, maintenance, and repair

- Private, nonmedical institutional services.

- Community support mental health services.

- Community support intellectual disabilities or autism.

- Home support services.

- Ancillary services related to telecommunications.

- Group residential brain injuries services.

These are nontaxable services:

- When the charge for repair or installation is separately stated from charges for parts or accessories, only the materials portion of the sale is subject to tax.

- If labor and materials are not separately stated but invoiced as one bundled price, the entire amount charged to the customer is taxable.

- When repairs do not include the sale of parts, no tax is charged to the customer.

More information can be found on pages 45 - 56 of Maine’s Reference Guide to Sales and Use Tax Law and in the Service Providers Guide.

Software

Many people ask questions about the taxability of software as a service (SaaS).

Many states already impose a tax on software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

For now, we’ve summarized Maine’s software tax rules here:

"Product transferred electronically" means a digital product transferred to the purchaser electronically, the sale of which in non-digital physical form would be subject to tax as a sale of tangible personal property.

Sales of digital products are subject to the general tax rate if the non-digital physical form would also be subject to sales tax. For example, the sale of digital music, books, magazines, newspapers, and movies is taxable since selling a CD, paper-bound book, DVD, and printed magazines and newspapers are taxable.

Sales of digital copies of a publication is taxable, provided the publication is downloadable to the subscriber's electronic device. The subscription is not taxable if the subscriber is allowed only to access and view an online version of the publication, but the seller may not download the digital copy.

Prewritten and Custom Software

That said, under Maine tax law, tangible personal property includes any computer software that is not a custom computer software program. Tangible personal property also includes any product transferred electronically. [§ 1752(17)]

"Custom computer software program" means computer software written only for a particular customer. “Custom computer software program” does not include a “canned” or prewritten program that is held for a general or repeated sale even if the seller first developed the program on a custom basis.

An existing prewritten program modified to meet a particular customer's needs is a "custom computer software program" to the extent of the modification and to the extent that the charges for the modification are separately stated.

When the location where the digital publication is being downloaded is not known, the purchasers billing address determines if the sale occurs in Maine or not. The subscription is taxable if the billing address is in Maine.

Shipping & Handling

Tax applies to cash sales and also to credit transactions and where the sale price is paid by barter or any other valuable consideration.

Cash on delivery charges constitute payment for the service of collecting the purchase price from the purchaser. Mileage charges, handling charges, wait charges, and fuel surcharges are services that are associated with a sale. All these charges are included in the taxable sale price, whether separately stated or not.

However, the cost of transportation when the shipment is made directly to the purchaser, provided those charges are separately stated, the transportation occurs through a common carrier, contract carrier, or the United States mail, is not taxable.

The costs of transporting property sold to the seller's location is part of the taxable sale price, whether it is separately stated to the customer.

Shipping and Handling rules can be found on page 22 of Maine’s Reference Guide to Sales and Use Tax Law.

If you are uncertain how the tax laws regarding shipping and handling could impact you, don't hesitate to contact one of our seasoned tax professionals.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Maine Revenue Services provides some specific guidance for the following industries:

Determining Local Sales Tax Rates in Maine

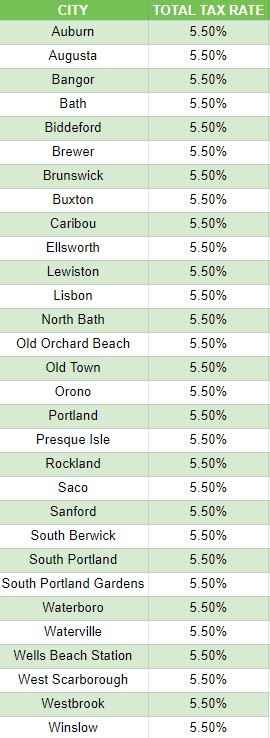

The state sales tax rate in Maine is 5.500%. Maine has no local taxes beyond the state rate. However, as we covered in the previous section, Maine does impose different tax rates depending on the items for sale.

Local Sales and Use Tax Tables

See the chart below for the tax rates of the most populated Maine cities.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Maine Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement in each State. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Maine sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

This is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Maine and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Maine’s lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

What to Expect During an Audit

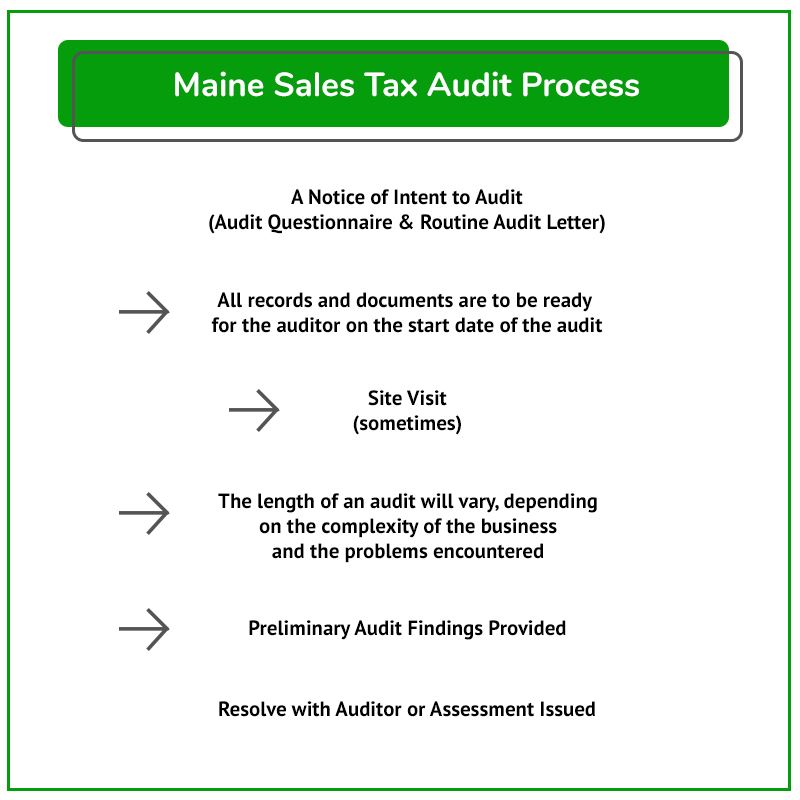

The typical audit process is shown in this flowchart. Detailed guidance for each Maine audit process stage follows in the sections below.

Maine regularly audits businesses required to charge, collect, and remit various taxes in the State. Many audits begin with a call from a Maine Revenue Services sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Maine sales tax audit.

When the audit is complete, the auditor will send you the assessment and the amount.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I received a Maine Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don't have sales tax audit experience, how can you trust that the State's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you thoroughly understand your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Maine sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from a Maine Sales Tax Auditor

Here is a summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Maine sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Maine sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

After reviewing all information, the auditor will prepare a proposed audit report which shows preliminary findings and a preliminary amount due or refund. The proposed audit report is the basis for discussion between you and the auditor; it is not a final determination. It may be estimated in cases where requested information has not been provided.

If a business buys an item online without paying use tax, the business is still obligated to remit the tax to Maine. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Maine Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

The auditor will meet you by phone or in person to present the proposed report and ensure you understand the proposed adjustments.

The auditor will produce an audit report with corresponding work papers to support the Maine sales and use tax assessment. After reviewing the documents, the auditor will then explain any adjustments.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Maine's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

Many businesses wind up drastically overpaying the State because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability.

In the following sections, we'll cover the process of challenging a Maine sales tax audit assessment.

Contesting Audit Findings with the Auditor

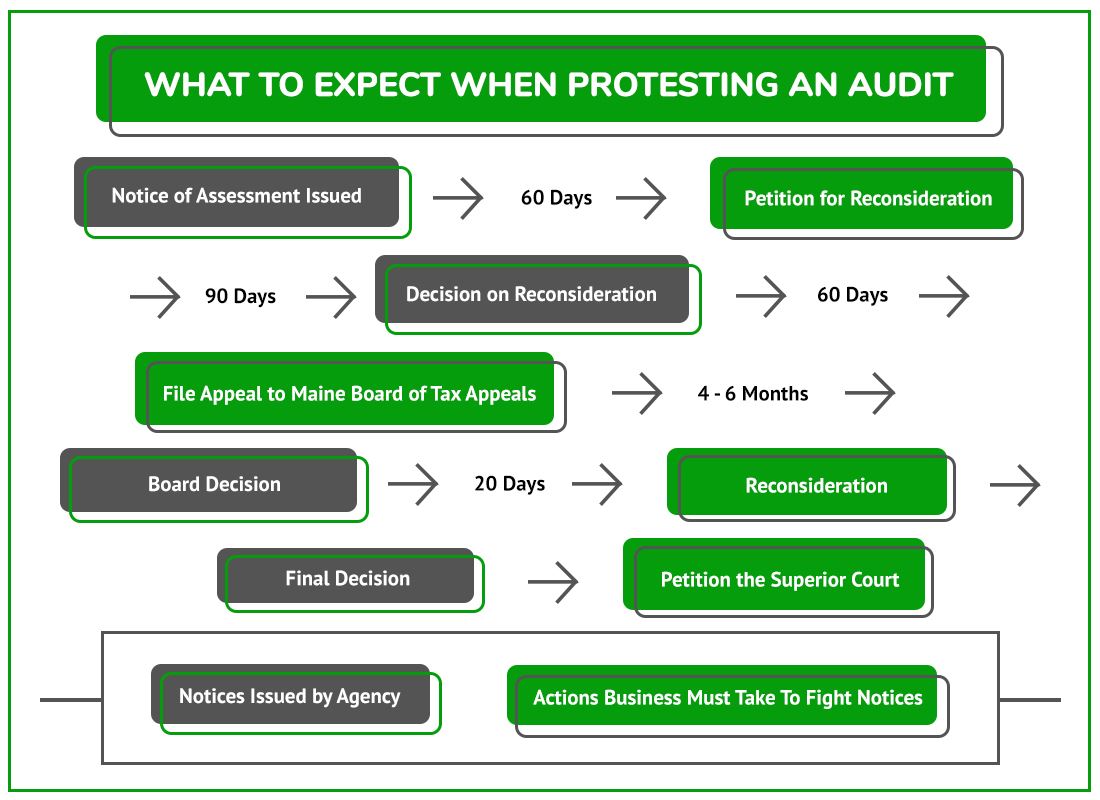

Maine Sales Tax Audit Protest Process Flow Chart

NOTE: These deadlines are critical. If missed, getting your case heard can be nearly impossible.

NOTE: These deadlines are critical. If missed, getting your case heard can be nearly impossible.

You will receive a Notice of Proposed Audit Report requesting you sign (generally within 30 days) to indicate if you agree or disagree with the proposed findings.

It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you have information that hasn't been provided or believe a mistake has been made, please promptly contact the auditor. If you disagree with the findings or how the audit was conducted, you can always discuss the results or address your concerns about the process with the auditor's manager. A Notice of Deficiency, Refund Determination, or No Change will be issued when the audit is completed.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

1. Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage.

After this conference, the auditor will adjust the audit assessment, and a Notice of Deficiency, No Change, or Refund Determination will be issued.

Appeal/Protest with The Maine Revenue Services

Protest Rights and Audit Finding Confirmation

If you believe the assessment is based on a mistake of fact or an error of law, you may request reconsideration with the Maine Revenue Services. Like most states, reconsideration must be requested in writing. It is advisable to provide as much documentation as possible to support your position and much legal authority to support your position. You can present your case during a meeting with Maine Revenue Services personnel and be represented by a Maine sales tax attorney, accountant, or sales tax consultant. It may also make sense to pay all of or a portion of the assessment to stop the accumulation of interest and it is appropriate to seek a payment plan during the reconsideration process.

Following the meeting and the presentation of documentational evidence, MRS will issue its decision on your case.

If you have received a Certificate of Assessment and haven't talked to someone experienced in Maine State tax, now is the time. Do it before these deadlines pass.

Final Decision

Maine Revenue Services will issue the final decision within 90 days of your reconsideration petition. If you disagree with the decision of the Revenue Services, the next step is a petition to the Board of Tax Appeals within 60 days of the decision. If you disagree with the decision of the Board of Tax Appeals, you may appeal to the Superior Court.

Settling a Maine Sales Tax Liability

After any critical notices are issued, settling your Maine sales tax case with the Maine Revenue Services is possible by filing a Maine Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Maine tax laws.

DO NOT attempt to negotiate a settlement without an experienced Maine state and local tax lawyer or other professional.

Contest a Maine Jeopardy Assessment

Maine may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Maine Revenue Services the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Administrative Hearing with The Maine Board of Tax Appeals

If you cannot resolve your case with the Maine Revenue Services through the informal reconsideration process, you will then have 60 days to appeal the decision to the Maine Board of Tax Appeals. The Board of Tax Appeals is a separate and independent agency from Maine Revenue Services charged with providing taxpayers with an avenue to resolve disagreements with Maine Revenue Services. It has a three-person board appointed by the Governor and regularly hears sales tax cases.

Although it is not required, it is advisable to have a seasoned sales tax attorney or other professionals on your side for this stage. The burden is on the taxpayer to show the decision by MRS is incorrect and should be overturned. After the board has received the appeal, the case will be assigned to an Appeals Officer. The officer will request evidence and argument to be submitted. Eventually, the case will be heard, and a decision rendered.

The decision is appealable to the judicial court, which is called the Maine Superior Court.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Maine Sales Tax Resources

Maine Revenue Services Sales Tax Website

Reviews

-

"Jerry Provided Calming, Clear Guidance"

I can't say enough about Jerry and STH. We were in a bit of a panic re reaching nexus levels and dealing with reseller tax ...

- Mike L. -

"My Entire Experience Was Superior"

My entire experience from intake to resolution with Sales Tax Helper was superior. '11' on a scale of 1-10! Initial meeting ...

- Tim N. -

"Prompt, Courteous & Helpful!"

I sincerely am grateful for the prompt, courteous, and helpful that has been offered me by Sales Tax Helper. My agent, Alex ...

- Carol M. -

"Professional and Very Communicative"

When my business needed guidance with sales and use tax, I reached out to Sales Tax Helper through their website and received ...

- Pierce L. -

"They Are Experts in Their Field"

Jerry & Alex are excellent at what they do. They helped me navigate some very difficult and stressful situations. They’re ...

- Greg M. -

"Excellent Team to Work With!"

The team at Sales Tax Helper was excellent to work with. I had a complex business sales tax challenge that they methodically ...

- Mike M. -

"Always Provide Accurate & Prompt Responses"

Alex and Jerry always provide very accurate and prompt responses to my inquiries regarding the sales tax. They also bring ...

- Lukas P. -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O.