Sales Tax Audit Overview

State Sales Tax Audit Assistance – Introduction and Overview

Up is down; down is up. He says “Hello” when he leaves; “Goodbye” when he arrives. – Jerry Seinfeld

Anyone that’s been through a sales tax audit can relate to the backward and bizarre world that is a state and local tax. Getting the notice that you have been selected by the state to go through the long, grueling, and often backward process of a state sales tax audit is daunting.

However, by having the right team, the audit does not have to be as stressful and burdensome as you might think. While some companies may opt for a state sales tax law firm, having a team that is experienced and knows how to play the audit game is more critical than having an expensive tax attorney. We have both tax audit experts and sales tax attorneys as part of our team and our goal is to provide the appropriate service for your business!

Sales Tax Audit Selection Process: How Did I Get So Lucky?

Most businesses that call us for state sales tax audit services ask how they got selected for audit in the first place. There is a percentage of companies that get randomly selected for sales tax audits, and you may have been one of those ‘lucky winners.’ But that’s usually is not the case. More commonly companies get selected because:

Targeted Industries

The state will often go after industries suspected of underreporting. Usually pegged as “campaigns” the state will have audits that are focused on a particular industry. A few of the industries most commonly audited are:

Cash-based businesses are of particular interest such as bars, restaurants, grocery, and liquor stores. It would “shock” you to know that cash-based businesses do not always report all their cash sales for federal or state tax purposes. In the past, auditors had a difficult time auditing such industries but thanks to third party reporting and much better industry average data, state sales tax departments are more effectively and efficiently able to audit such industries.

Industries with complex and confusing sales tax laws or rules. If even the best sales tax attorney, CPA, or professional has a tough time understanding it, how do you think the average business owner fares? Industries with “gotcha” type rules are often prime candidates for audit notices. Real property improvement contractors come to mind and are often audited by the state for gotcha type taxes on transaction types.

Prior Audits – Typically a company that is audited and owes sales tax, as a result, is likely to get hit again to see if they cleaned up their act.

Gross Sales – If your business has a high volume of sales or your sales reported to a state are different than your federally reported sales, it could be a sales tax audit flag.

Exempt Sales – You’ve already paid tax on your taxable sales, so having a high volume of exempt sales can be a sales tax collection opportunity for the state sales tax audit department.

Exempt Sales % – If your business reports a higher percentage of exempt sales compared to the industry averages, you could be up next for a sales tax audit.

Refunds or Credits – The line on the sales and use tax return should be changed to “AUDIT ME.” Many businesses that take a higher number of credits on their return have a high likelihood of getting a sales tax audit. The same holds true for filing a refund claim for sales tax.

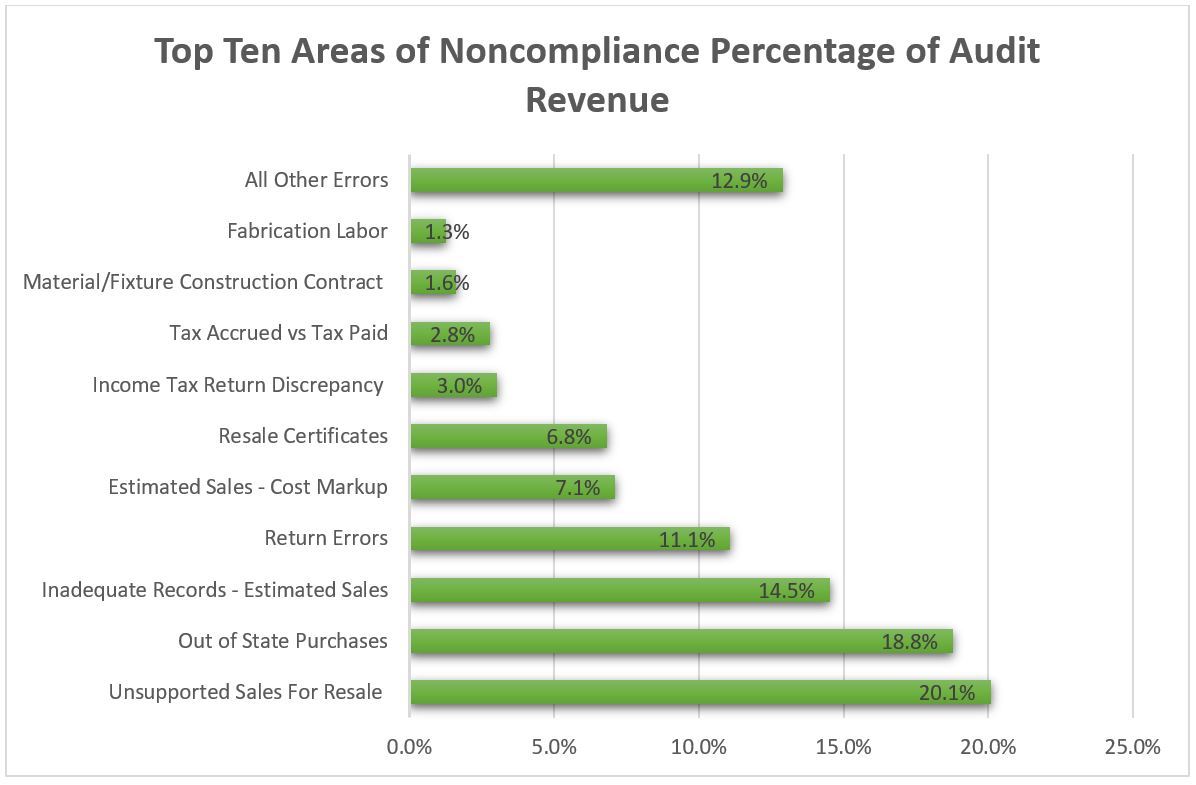

According to CDTFA in California, the following are top audit errors for 2017-18

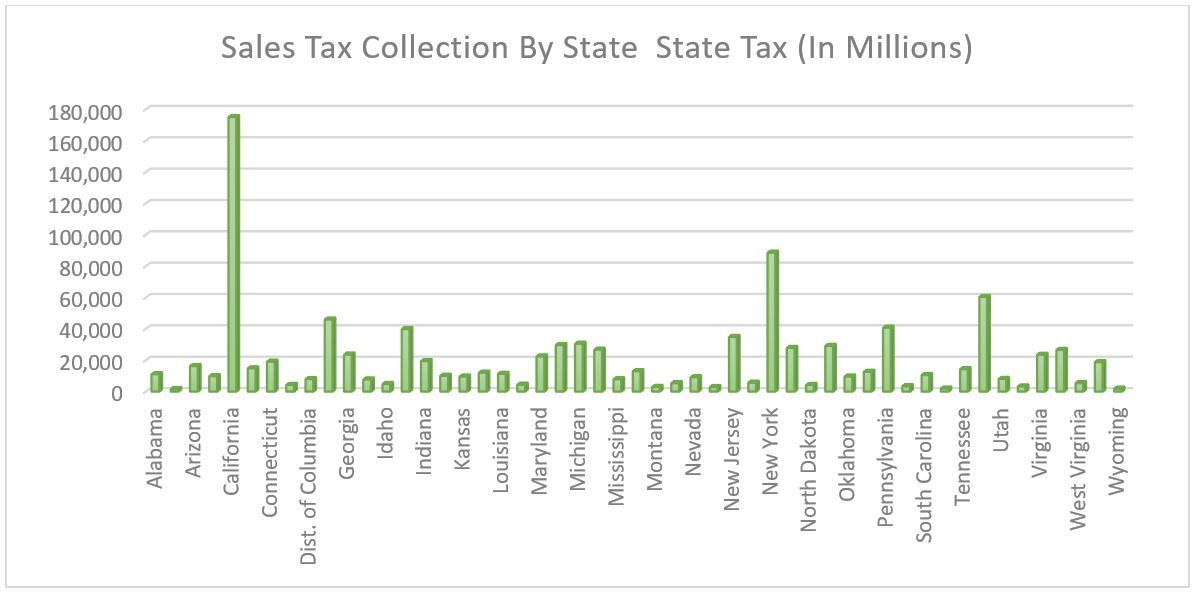

State taxes, including sales and use tax, are a huge revenue source for states.

The Federation of Tax Administrators published some state tax revenue statistics in 2017, including the amount

of tax revenue by state:

State taxes, including sales and use tax, are a huge revenue source for states.

The Federation of Tax Administrators published some state tax revenue statistics in 2017, including the amount

of tax revenue by state:

A sales tax audit puts the pressure on taxpayers in their guilty until proven innocent audit tactics. The auditors are taught when in doubt, write it up, and make the taxpayer prove otherwise. Managing and controlling the audit so the auditor does not have the option to write it up can be a tactical advantage. However, if it is written up, you must keep clawing away at the assessment through the appeals and protest process to reduce it.

Just as you are well versed in managing your business, our business is managing and fighting your audit for you. Whether you need a sales tax attorney or consultant, Sales Tax Helper matches the service to meet your needs. If you want to take on the audit yourself, without a sales tax lawyer or professional, our site has useful information to help you navigate through these treacherous waters.

Reviews

-

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A. -

"Responsive and Provide Invaluable Knowledge"

Salestaxhelper.com is run by true professionals that understand the complexities of operating a multi-state business. They're ...

- Brennan A.