Iowa Sales Tax & Audit Guide

Straightforward Answers to Your Iowa Sales Tax Questions.

- Do I need to collect Iowa sales tax?

- Should I be collecting or paying Iowa use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Iowa.

Who Needs to Collect Iowa Sales and Use Tax?

Like most states, to be subject to Iowa sales tax collection and its rules, your business must:

1) Have nexus with Iowa, and

2) Sell or use something subject to Iowa sales tax.

How is Nexus Established in Iowa?

According to the Iowa Department of Revenue, a retailer with a physical presence in Iowa is any retailer with any permanent or temporary place of business, employee, or other representatives or property in Iowa.

A retailer with a physical presence in Iowa must collect Iowa sales tax. A typical example is a retailer that has a store in Iowa, sends sales representatives to Iowa, or sets up a temporary booth to sell items at fairs or trade shows in Iowa.

Additionally, businesses that do not have a physical presence in Iowa can establish economic nexus by exceeding the annual sales threshold covered in the next section.

Economic Nexus (Wayfair Law) and Internet Sales in Iowa

Out-of-state retailers

A remote seller makes retail sales of tangible personal property, services, or specified digital products in Iowa but doesn't have a physical presence in Iowa. A remote seller makes sales in Iowa in various ways, including by phone, catalog, or website.

Remote sellers must collect Iowa sales tax if they have $100,000 or more in gross revenue from Iowa sales.

A remote seller must collect and remit Iowa sales tax starting January 1, 2019, if their previous calendar year's sales exceed the economic nexus threshold.

Example: Seller A is a remote seller making retail sales of clothing delivered to Iowa. Seller A has not had a physical presence in Iowa. During the calendar year 2018, Seller A received $150,000 in gross revenue from sales of clothing delivered to Iowa. Since Seller A has received $100,000 or more in gross revenue from Iowa sales during the calendar year 2018, Seller A must begin collecting Iowa sales tax on January 1, 2019.

Marketplace facilitators

The Iowa tax reform bill requires marketplace facilitators like Etsy to collect sales tax for sellers using their marketplace. Marketplace facilitators without a physical presence in Iowa are required to collect Iowa sales tax once the combined total of their sales in Iowa and third-party sales in Iowa exceeds $100,000 in the current or previous year. They must have separate seller permits for their sales in Iowa and third-party sales.

Marketplace sellers might not need to register or collect sales tax. Marketplace sellers should contact their marketplace to determine whether they need to collect Iowa sales tax on sales made through the marketplace.

How is the $100,000 gross revenue threshold calculated?

The total revenue generated from Iowa sales is included in the gross revenue calculations.

All retail sales, taxable or exempt, and any other sales (wholesale, resale, etc.) of tangible personal property, services, and specified digital products sold into Iowa. Iowa sales include all sales made by a remote seller through a marketplace or other means.

However, certain charges are excluded from a transaction’s sales price:

- A credit card processing fee on a nontaxable sale is not itself subject to tax.

- Discounts

- Interest, finance, or carrying charges

- Charges that are itemized on a receipt, such as delivery or installation service charges

- Other taxes

Which Sales are Subject to Iowa Sales Tax?

General Transactions

Iowa imposes a tax on the sales price of transactions made by retailers who sell tangible personal property, taxable services, or specified digital products. Retailers must collect, report, and remit a 6% sales tax on these transactions. An additional local tax of 1% applies to most sales in many jurisdictions. There is no local option use tax.

The rules seem simple, but many details make applying Iowa’s tax rules to your business challenging. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Iowa Sales and Use Tax:

Many activities and goods in Iowa are both taxable and nontaxable, depending on specific circumstances surrounding the transaction. The items listed here are examples; the lists here are not exhaustive. For detailed information about conditions for exemptions, see the last chapter of The Iowa Sales and Use Tax Guide.

- Food

- Casual sales of a nonrecurring nature are exempt from sales tax in Iowa when the seller is not engaged in selling tangible goods or taxable services for a profit. If so engaged, the casual sale is outside the regular course of business.

- Fuel used for heating or cooling, electricity, machinery and equipment, auxiliary attachments, replacement or repair parts, and water when used to produce flowering, ornamental, or vegetable plants in commercial greenhouses or other places for sale.

- Sales or rentals to printers and publishers of various supplies used to complete a finished printed product for retail sale.

- Solar Energy Equipment

- conference room rentals and banquet rooms are exempt from state tax, local option tax, and local hotel and motel tax

Services

The following are taxable services in Iowa:

- Wrecker and towing

- Wrapping, packing, and packaging of merchandise other than processed meat, fish, fowl, and vegetables

- Wood preparation (for example, stripping, cleaning, sealing)

- Well drilling (repair only)

- Welding

- Weighing

- Water conditioning and softening

- Video game services and tournaments

- Vehicle wash and wax

- Vehicle repair

- Turkish baths and reducing salons

- Tree trimming and removal

- Tin and sheet metal repair

- Test laboratories, excluding tests on humans and animals and environmental testing

- Telephone answering service and telephone services

- Telecommunication services, excluding Internet access fees

- Taxidermy

- Tanning beds or tanning salons

- Swimming pool cleaning and maintenance

- Storage warehouse or lockers of raw agricultural products

- Storage of tangible or electronic files, documents, or other records

- Storage of household goods

- Software as a service

- Sign construction and installation

- Shoe repair and shoeshine

- Sewing and stitching

- Sewage services, nonresidential commercial only

- Services related to installing, maintaining, servicing, repairing, operating, upgrading, or enhancing specified digital products

- Security and detective services

- Roof, shingle, and glass repair

- Retouching photographs

- Reflexology

- Plumbing, including drain cleaning and unplugging toilets, sinks, and sewers

- Pipe fitting

- Photography

- Pet grooming

- Personal transportation service

- Pay television, including but not limited to streaming video, video-on-demand, and pay-per-view.

- Parking facilities

- Painting, papering, and interior decorating

- Oilers and lubricators on vehicles and machines

- Office and business machine repair

- Motorcycle, scooter, and bicycle repair

- Motor vehicle, recreational vehicle, or recreational boat rental (when rented without a driver or operator)

- Motor repair

- Mini storage

- Massages performed by an unlicensed massage therapist

- Machine repair of all kinds

- Machine operator fees

- Landscaping, tree trimming, and lawn care

- Jewelry and watch repair

- Janitorial and building maintenance or cleaning (nonresidential only)

- Investment counseling

- Information services

- Household appliance, television, and radio repair

- House and building moving

- Gun Repair

- Golf and country clubs and all commercial fees, dues, and charges

- Garbage collection and disposal, nonresidential commercial only

- Furniture repair and cleaning

- Fur storage and repair

- Flying service and instruction

- Farm implement repair of all kinds

- Extermination services

- Excavating and grading

- Employment and executive search agencies

- Electrical and electronic repair and installation

- Dry cleaning, laundering, pressing, and dyeing, excluding the use of self-pay washers and dryers

- Demolition

- Dating services

- Dance school and dance studio

- Communication services, excluding Internet access fees

- Carpet, rug, and upholstery cleaning and repair

- Carpentry repair and installation

- Campgrounds

- Camera repair

- Boat Repair

- Battery, tire, and allied services

- Barber and beauty services

- Bank and financial institution service charges

- Armored car services

- Alteration and garment repair

- Aircraft repair, maintenance, or remodeling, except when used in a scheduled or nonscheduled interstate FAA-certified air carrier operation.

- Aircraft lease or rental of 60 days or less

These are nontaxable services:

- Unless taxed explicitly by state law, sales of services are not subject to Iowa sales tax

- Services in connection with new construction, reconstruction, expansion, or remodeling of a structure

- Services to recondition or repair tangible personal property sold in the regular course of a retailer’s business and offered for sale by the retailer after service is rendered.

See also: Iowa Sales and Use Tax: Taxable Services

Software

Many people ask questions about the taxability of software as a service (SaaS).

Many states already impose a tax on software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

For now, we’ve summarized Iowa’s software tax rules below.

Sales of the following are subject to Iowa sales tax and applicable local option sales tax:

- Computer hardware

- Software delivered in physical or digital form

- Services related to installing, repairing, maintaining, operating, upgrading, servicing, or enhancing specified digital products.

- Software as a service. (See exempt items below for exceptions) Sale, storage, use, or consumption of vendor-hosted computer software, software accessible on the cloud. "Vendor-hosted computer software" means computer software accessed through the internet or a vendor-hosted server, permanent or temporary, whether any downloading occurs, regardless of who is hosting or the content accessed.

- Storage of tangible or electronic documents, files, and other records

- The sale of storage services for tangible or electronic files, documents, or other records is

- Information Services. Access to a database or subscription to information provided through any tangible or electronic medium. Examples of information services include the following:

- Database files

- Research databases

- Genealogical information

- Mailing lists

- Subscription files

- Credit reports

- Surveys

- Real estate listings

- Bond rating reports

- Abstracts of title

- Bad checklists

- Broadcasting rating services

- Wire services

- Price lists or guides

- Scouting reports

- Software as a Service

- Video game services and tournaments. Access to video games, in-game currency exchanges, payment processing services, and other services related to hosting games. A video game is any virtual, digital, or electronic game where users interact with an interface, generating visual feedback on a video device like a computer monitor or other screen. Video games are transferred through any physical or electronic medium, including cartridge, disc, or electronic file, or via any server or network of servers.

Exempt items include:

- Computers and peripherals used by a manufacturer or in the processing or storage of data by a financial institution, insurance company, or commercial enterprise

- Web Hosting. An online service that allows users to publish their files onto the internet to make a website available for the public to access. The Iowa Department of Revenue previously determined web-based storage to be taxable as "storage of tangible or electronic files, documents, or other records ."However, web hosting is focused on the publication of the data, not mere storage. Web hosting is also not an enumerated service when offered in a traditional manner. Additional cloud-based services may include web hosting, but such services are generally considered "infrastructure as a service (IaaS)." Iowa law only imposes a tax on "software as a service" (SaaS). Therefore, web hosting is not a taxable service in Iowa.

Some software and software-related sales are exempt from sales tax when purchased by a commercial enterprise as defined by Iowa tax law and used exclusively by or furnished to that commercial enterprise. Commercial enterprise is any of the following:

- For-profit businesses and manufacturers

- Insurance companies (nonprofit and for-profit),

- Financial institutions (nonprofit and for-profit),

- Certain professions are defined in Iowa Administrative Code rule 701-230.18(3)(c), For example, medical offices, law firms, farming operations, etc.

For businesses that fall under the commercial enterprise definition, the following sales are exempt from sales tax:

- Specified digital products

- Prewritten computer software

- Storage of tangible or electronic files, documents, or other records

- Information services

- Services related to installing, maintaining, servicing, repairing, operating, upgrading, or enhancing specified digital products; and

- Software as a service

Shipping & Handling

Taxable

Inbound freight/freight-in charges do not fall within the definition of delivery charges. They are taxable when added to the price of a taxable retail sale.

Example: A purchaser wishes to buy a product from a retailer, but the retailer doesn't have the item in stock and must order the product. If the retailer prices the product at a certain amount, plus the shipping costs associated with obtaining the product by calling their supplier, those associated costs (freight-in) are not exempt from delivery charges even if separately stated. These charges reflect the fees a seller may incur to secure possession of the product from their supplier.

Exempt

Delivery charges are necessary to send the product from the seller to the purchaser if separately invoiced or separately stated on the bill.

If you are uncertain how the tax laws regarding shipping and handling could impact you, don't hesitate to contact one of our seasoned tax professionals.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Iowa Department of Revenue provides some specific guidance for the following industries:

- Sales Tax Treatment of Computers and Computer Peripherals (iowa.gov)

- Iowa Contractors Guide

- Iowa Local Option Tax Information

- Iowa Tax on Gambling

- Iowa Sales Tax on Food

- Iowa Sales Tax on Discounts, Rebates, and Coupons

- Iowa Contractors Guide

- Farmers Guide to Iowa Taxes

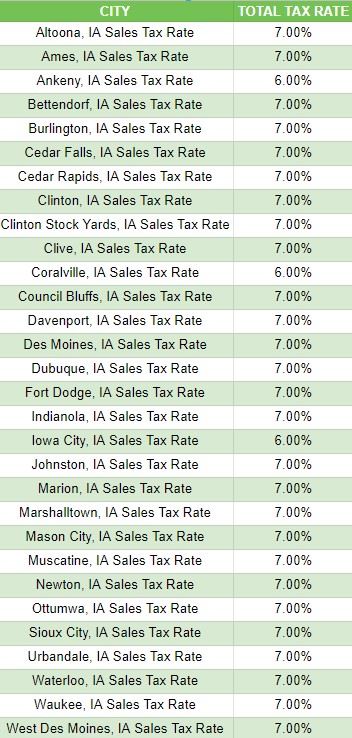

Determining Local Sales Tax Rates in Iowa

Unless otherwise noted, the tax for all taxable items shown below is 6% state tax, plus local tax, where applicable.

Local Sales and Use Tax Tables

See the chart below for the tax rates of the most populated Iowa cities.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Iowa Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement in each State. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Iowa sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Iowa and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Iowa’s lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

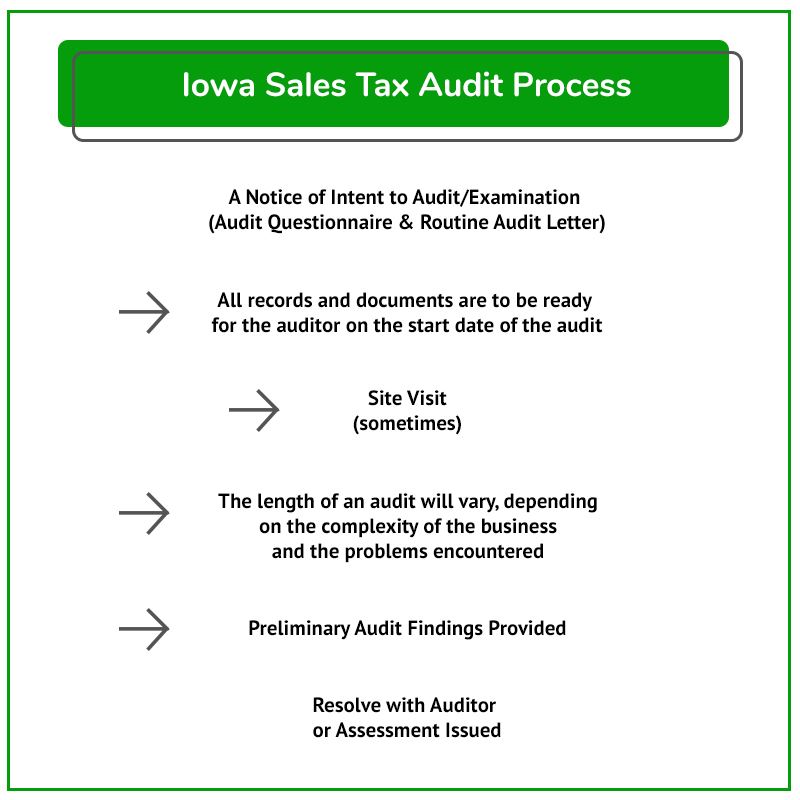

What to Expect During an Audit

The typical audit process is shown in this flowchart. Detailed guidance for each Iowa audit process stage follows in the sections below.

Iowa regularly audits businesses required to charge, collect, and remit various taxes in the State. Many audits begin with a call from an Iowa Department of Revenue sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for an Iowa sales tax audit.

Once the audit is complete, the auditor will send you the assessment and the amount.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I received an Iowa Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don't have sales tax audit experience, how can you trust that the State's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you thoroughly understand your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Iowa sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from an Iowa Sales Tax Auditor

Here is a summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Iowa sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Iowa sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

After reviewing all information, the auditor will prepare a proposed audit report which shows preliminary findings, and a preliminary amount due or refund. The proposed audit report is the basis for discussion between you and the auditor; it is not a final determination. It may be estimated in cases where requested information has not been provided.

Suppose a business buys an item online without paying use tax. In that case, the business is still obligated to remit the tax to Iowa. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Iowa Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

The auditor will meet you by phone or in person to present the proposed report and ensure you understand the proposed adjustments.

The auditor will produce an audit report with corresponding work papers to support the Iowa sales and use tax assessment. After reviewing all the documents, the auditor will explain any adjustments.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Iowa's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the State because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

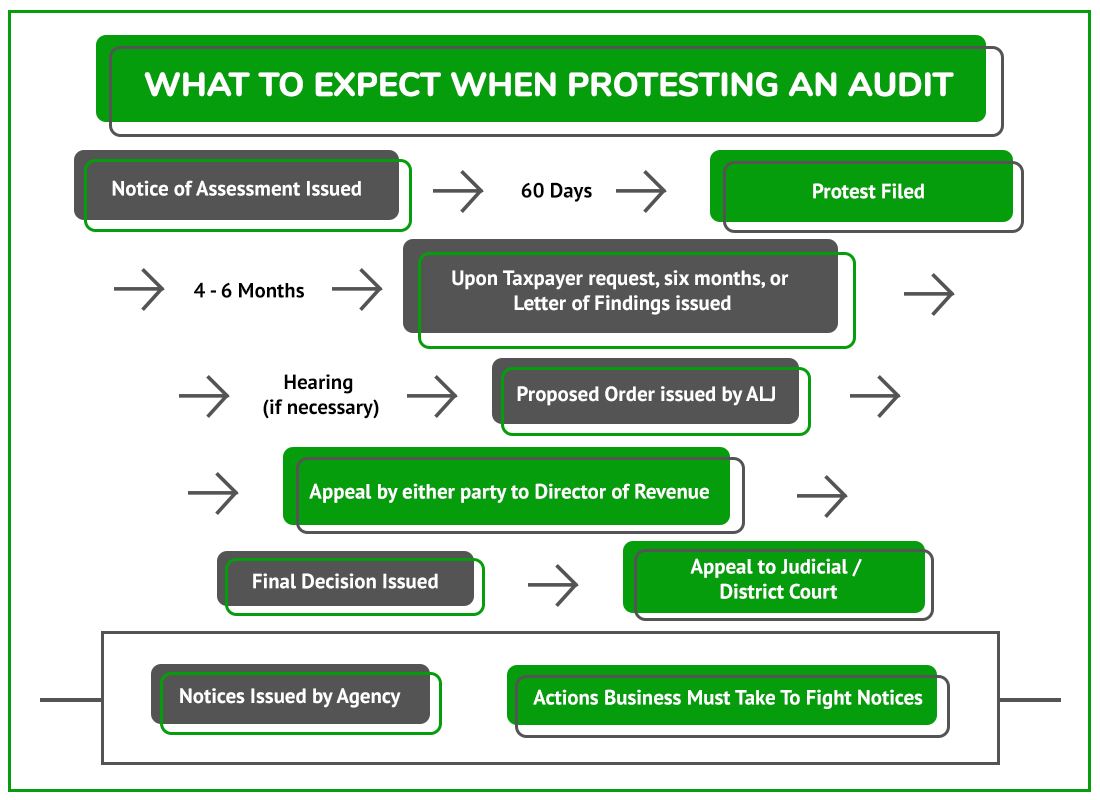

In the following sections, we'll cover the process of challenging an Iowa sales tax audit assessment.

Contesting Audit Findings with the Auditor

Iowa Sales Tax Audit Protest Process Flow Chart

NOTE: These deadlines are critical. If missed, getting your case heard can be nearly impossible.

You will receive a Notice of Proposed Audit Report requesting you sign (generally within 30 days) and indicate whether you agree or disagree with the proposed findings.

It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you have information that hasn't been provided or believe a mistake has been made, please promptly contact the auditor. If you disagree with the findings or how the audit was conducted, you can always discuss the results or address your concerns about the process with the auditor's manager. A Notice of Deficiency, Refund Determination, or No Change will be issued when the audit is completed.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

1. Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage.

After this conference, the auditor will adjust the audit assessment, and a Notice of Deficiency, No Change, or Refund Determination will be issued.

Appeal/Protest with The Iowa Department of Revenue

Protest Rights and Audit Finding Confirmation

You will receive a Letter of Findings if the matter is still not resolved after informal hearings. You may request a hearing if you disagree with the Letter of Findings. Failure to respond to a Letter of Findings or other requests on time can result in the dismissal of your appeal.

If a properly filed appeal is pending for at least six months, you can make your written request to the Legal Services and Appeals Division and open a contested case, which will require the Department to file an Answer within 30 days.

Once the Department files its Answer, an Administrative Law Judge will send a Hearing Notice with the time, date, and location for the hearing.

If you have received a Certificate of Assessment and haven't talked to someone experienced in Iowa State tax, now is the time. Do it before these deadlines pass.

Final Decision

After the hearing, the Administrative Law Judge will issue a proposed order. If you agree with the order, the matter is resolved unless the Department or the Director reviews the proposed order on their own motion.

Any party involved who disagrees with the order may appeal to the Director of the Department for a decision.

If you disagree with the Director's decision, you can appeal to the District Court. District Court decisions can be appealed to the Iowa Supreme Court.

Settling an Iowa Sales Tax Liability

After any critical notices are issued, settling your Iowa sales tax case with the Iowa Department of Revenue is possible by filing an Iowa Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Iowa tax laws.

DO NOT attempt to negotiate a settlement without an experienced Iowa state and local tax lawyer or other professional.

Contest an Iowa Jeopardy Assessment

Iowa may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Iowa Department of Revenue the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Administrative Hearing with The Iowa Department of Revenue

If you cannot resolve your case through informal procedures with the Iowa Department of Revenue, you can have your sales tax assessment case heard before an Administrative Law Judge (ALJ). While some states allow you to challenge the agency by filing in administrative court, Iowa gives you a few paths to get before an administrative law judge.

Most cases that cannot be resolved informally with the agency culminate in a Letter of Findings. Upon issuance of the Letter of Findings, your business or your sales tax professional can request a hearing. Alternatively, you can request a hearing without waiting for the Letter of Findings if the case has been sitting for six months.

Irrespective of the route, when the case finally gets before an administrative law judge, the proceeding resembles a regular court proceeding. During the hearing, the ALJ hears testimony from witnesses and receives evidence. Having a sales tax professional or lawyer on your team is critical, as managing a court-like proceeding is not intuitive for most business owners. It is also crucial to develop the record as facts and evidence not presented may not be considered if you have to appeal the case further.

At the end of the hearing, the ALJ issues a proposed order. The proposed ruling goes back to the agency, which can adopt or reject some of the conclusions made by the ALJ. The agency makes its final decision which is appealable to a regular judicial court. While it seems (and is) very unfair to the taxpayer, many states operate in this fashion.

Like many areas of the law, the further up the chain you take the case, the more likely it is to settle. For this reason, it is very often worthwhile to contact a sales tax lawyer, accountant, or other professional to evaluate your case at every step if you think your assessment is higher than is warranted.

Our team has handled hundreds of administrative court cases. We can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Iowa Sales Tax Resources

Iowa Department of Revenue Sales Tax Website

Iowa Sales & Use Tax Guide | Iowa Department of Revenue

Tax Guidance | Iowa Department Of Revenue

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.