Hawaii (Sales) GET Tax & Audit Guide

Straightforward Answers to Your Hawaii Sales Tax Questions.

- Do I need to collect Hawaii sales tax?

- Should I be collecting or paying Hawaii use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Hawaii.

Who Needs to Collect Hawaii Sales and Use Tax?

Like most states, to be subject to Hawaii sales tax collection and its rules, your business must:

- Have nexus with Hawaii, and

- Sell or use something subject to Hawaii sales tax.

Economic Nexus (Wayfair Law) and Internet Sales in Hawaii

According to the Hawaii Department of Taxation, Hawaii does not have a sales tax. Instead, it imposes a General Excise Tax. The GET differs from a sales tax in the following ways:

- a. A sales tax is a tax imposed on customers, whereas GET is a tax on businesses; and

- b. Businesses must collect sales tax from customers, whereas businesses are not required to collect GET from their customers.

Businesses must pay GET whether they charge their customers for it. It is common for retailers to charge their customers GET by visibly passing it on, but it is not required by law.

Consumer protection laws restrict retailers from charging more GET than they will pay for the sale. The Office of Consumer Protection takes immediate action against retailers that charge more tax than what is due.

- Tax Facts 37-1 (hawaii.gov)

- General Excise Tax (GET) Information | Department of Taxation (hawaii.gov)

- Register Your Business in Hawaii

Marketplace Sellers and Facilitators

A marketplace facilitator or marketplace seller engaged in business in the State must register for GET licenses before January 1, 2020, or before starting business activities, whichever is later.

Any marketplace facilitator or marketplace seller with a physical presence in Hawaii is engaged in business in the State and must register for a GET license.

of the economic thresholds established by Act 41, Session Laws of Hawaii 2018 (Act 41) are met.

Act 41 is applicable to all taxpayers without a physical presence in the State, including both marketplace facilitators and sellers. Marketplace facilitators and sellers without a physical presence are deemed engaged in business in the State if the taxpayer has gross income sourced to the State of Hawaii is $100,000 or more or if they have 200 or more transactions in Hawaii.

Marketplace sellers engaged in business in Hawaii are subject to GET at the retail rate for:

- The sellers own retail sales made into the State.

Marketplace sellers engaged in business in Hawaii are subject to GET at the wholesale rate for:

- Sales of tangible personal property made via a marketplace facilitator when the marketplace seller sends items to a retail purchaser in the State.

- Sales of tangible personal property delivered to a marketplace facilitator in the State before the retail sale; and

- Sales of services ultimately used and consumed in the State sold through a marketplace facilitator

Marketplace Facilitators

Marketplace facilitators engaged in business in Hawaii are subject to GET at the retail rate for:

- The facilitator's sales made into the State; and

- Sales through its marketplace into Hawaii, whether the seller is registered to do business in the State.

- Marketplace facilitators are subject to use tax at the wholesale rate for:

- Sales of tangible personal property via a marketplace when the marketplace seller is not engaged in business in Hawaii.

- Sales of tangible property delivered to the marketplace facilitator outside of the State before a sale through the marketplace; and

- Sales of services ultimately used and consumed in the State through the marketplace when the seller is not engaged in business in Hawaii.

As of 2019, the Department excludes the following taxpayers:

- A travel agent who arranges for transient accommodations; and

- A travel agent who merely arranges for tourism-related services as defined in section 237-18(f), HRS.

How is gross revenue calculated?

Businesses are subject to GET on gross receipts from sales in Hawaii. Gross receipts include all business income before any business expenses are deducted.

Marketplace facilitators must combine their sales made into Hawaii with their marketplace sales made into Hawaii to determine whether the thresholds have been met.

If the marketplace facilitator with whom the marketplace seller makes sales is engaged in business in the State, the marketplace seller must combine the following to arrive at the gross amount:

- Sales of tangible personal property made into Hawaii outside of the marketplace facilitator.

- Sales of tangible personal property made through any marketplace facilitator if the marketplace seller sends the property into Hawaii, either directly to the purchaser or a marketplace facilitator for resale; and

- Sales of intangible property and services made into the State, regardless of whether the seller made the sale through a marketplace facilitator if the intangible property or services are ultimately used or consumed in the State.

Taxpayers must allocate their gross proceeds and gross income to the designated taxation districts under Hawaii Administrative Rules Sections 18-237-86-01 through 18-237-86-10.

Which Sales are Subject to Hawaii Sales Tax?

General Transactions

The majority of activities are taxed at 0.5%, 4%, or 4.5%. Here are some examples:

0.5% Wholesaling goods, producing, manufacturing, providing wholesale services, business activities of disabled people

4% or 4.5% Selling retail goods and services, renting, leasing real property, construction contracting, earning commissions

We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Hawaii Sales and Use Tax:

There are no tax exemptions based on an entity's tax-exempt status and no tax exemption certificates to tax-exempt organizations, credit unions, or government agencies to exempt purchases from retailers in Hawaii.

There are religious and nonprofit organizations such as churches and universities that are exempt from income taxes, but GET is imposed on businesses, not customers, so sales to these organizations are still subject to GET.

A retailer may charge GET when a tax-exempt organization purchases tangible property.

The sale is exempt when a business sells goods to the military, credit unions, or government entities, and the business may claim a deduction.

There is no exemption for goods sold in Hawaii to nonresidents. No tax exemption certificates exist for tourists or nonresidents to exempt their purchases from Hawaii retailers.

However, if the Hawaii retailer ships the goods directly to the customer's out-of-state residence, the sale is exempt, and the retailer can take a deduction.

If the customer takes delivery of the goods in Hawaii, and then ships the goods out-of-state, the sale is subject to GET. SNo. 98-5, “General Excise Tax Exemption for Tangible Personal Property, Including Souvenirs and Gift Items, Shipped out of the State,” and Form G-61, “Export Exemption Certificate for General Excise and Liquor Taxes,”

Services

Software

Many people ask questions about the taxability of software as a service (SaaS).

Many states already impose a tax on software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

For now, we’ve summarized Hawaii’s software tax rules below.

Prewritten Software

Under Hawaii law, canned or prewritten software is considered tangible personal property (TPP), and is taxable, regardless of whether the software is contained on a tangible medium, such as a disc, or transferred electronically.

Software contained on a tangible medium, which is instead offered as a license to use the software, rather than a complete sale of the software itself where the purchaser has no restrictions on its use (reproduction, resale, etc.) and maintains possession of the property, is taxable. In other words, selling a license to use prewritten or canned software (SaaS) will also be treated as the sale of TPP.

Custom Software

The Department considers made-to-order or custom software a provision of services. A taxpayer producing custom software for a licensed seller provides a service to the seller, regardless of whether the custom software is transferred as a license to use the custom software or a sale of tangible property.

Appropriate Tax Rate

Sales of TPP are subject to GET at the rate of 4 percent, however, a wholesaler is subject to GET at a lower wholesale rate of 0.5 percent.

A wholesaler is a person who sells goods to a licensed seller for resale purposes.

This wholesale tax rate may apply to prewritten or canned software sold or licensed to a licensed seller for resale or relicensing.

Please see Hawaii Revised Statutes (HRS) §237-13(2)(A). 2 HRS §237-13(2)(A)HRS section 237-4 for the requirements.

A wholesaler of services is subject to GET at the wholesale rate of 0.5 percent. Wholesalers must meet all the requirements of HRS section 237-4(a)(10) to be eligible for the wholesale rate for the sale of services. If all requirements for wholesale treatment are met, the licensed seller may issue a resale certificate to the vendor. Resale certificates for goods and services are available on the Department's website at tax.hawaii.gov/forms.

Marketplace Facilitators If the software is sold or licensed through a "marketplace facilitator," then the marketplace faclilitator is deemed to be the retail seller and is therefore subject to GET at the rate of 4 percent.

The marketplace seller, on whose behalf the sale or licensing of the software is made, is deemed to have made a sale at wholesale under HRS section 237-4.

For more information, see TIR No. 2019-03.

Shipping & Handling

Retailers who ship tangible goods into Hawaii are responsible for GET on the total gross proceeds of the sale, including any shipping or delivery charges.

If you are uncertain how the tax laws regarding shipping and handling could impact you, don't hesitate to contact one of our seasoned tax professionals.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Hawaii Department of Taxation provides some specific guidance for the following industries:

- Hawaii Contractors Guide

- Churches & Ministers

- Manufacturers and Producers

- Business Tax Incentives

- Medical and Dental Providers

- Use Tax

- Film Industry

- Agriculture

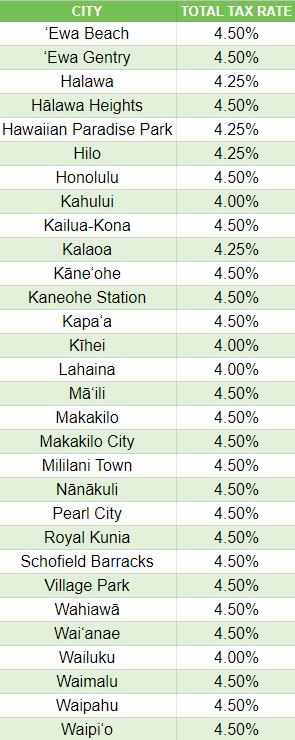

Determining Local Sales Tax Rates in Hawaii

Local taxes are on the business, not the consumer. However, if the business passes on its GET tax to the consumer, these are the maximum pass-on rates, including the county surcharge:

- 4.7120%: (effective January 1, 2007 – December 31, 2030) City and County of Honolulu 4.4386%: (effective January 1, 2019 – December 31, 2019)

- 4.7120%: (effective January 1, 2020 – December 31, 2030) County of Hawaii

- 4.7120%: (effective January 1, 2019 – December 31, 2030) County of Kauai

- 4.1666%: County of Maui

Local Sales and Use Tax Tables

See the chart below for the tax rates of the most populated Hawaii cities.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Hawaii Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement in each State. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Hawaii sales tax, here are your options:

- Register and pay back taxes, penalties, and interest, or

- Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Hawaii and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

Taxpayer Advocate | Department of Taxation (hawaii.gov)

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Hawaii’s lookback period is (10) ten years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

Voluntary disclosure limits the lookback period to (10) ten years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than ten years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

Tax Clearance Certificate

The Department of Taxation issues a tax clearance certificate certifying that a taxpayer is compliant with the tax laws of Hawaii (Title 14, Hawaii Revised Statutes) and has filed all required tax returns, and paid or has an active payment plan to settle all liabilities due as of the date the certificate is issued.

DOTAX and the IRS will periodically check your records and contact you if you don't pay your taxes. If your delinquency is not resolved, you can use your progress payments to pay your state and federal taxes, including penalties and interest. The state will not use your progress payments to pay your taxes as long as you file your tax returns, pay your taxes, and pay your installment payments on time. (Section 103-53(b), HRS.

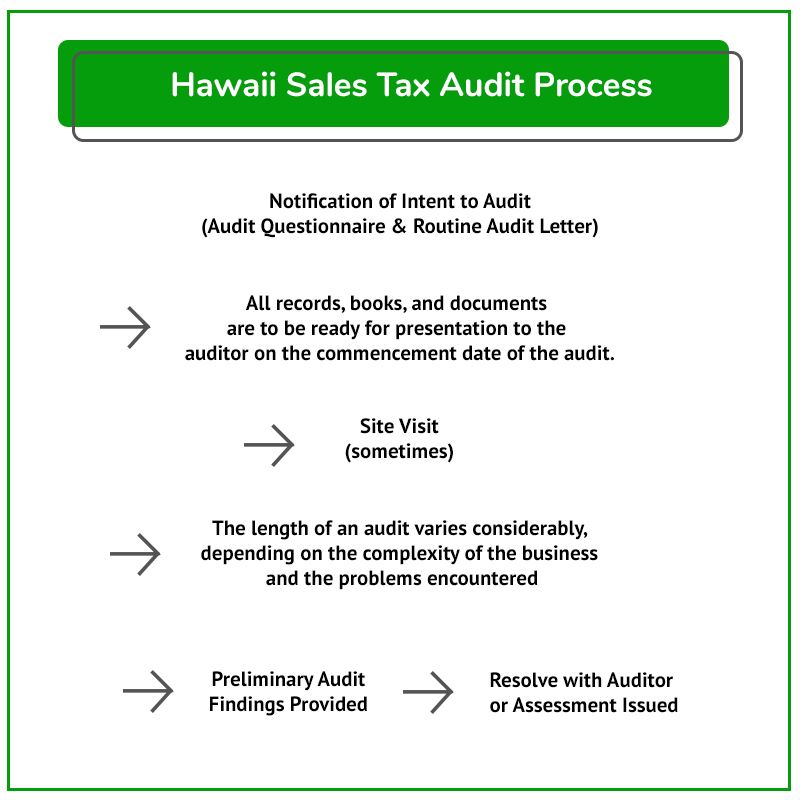

What to Expect During an Audit

The typical audit process is shown in this flowchart. Detailed guidance for each Hawaii audit process stage follows in the sections below.

Tax Collection Services | Department of Taxation (hawaii.gov)

Hawaii regularly audits businesses required to charge, collect, and remit various taxes in the State. Many audits begin with a call from a Hawaii Department of Taxation sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky to be chosen for a Hawaii sales tax audit.

When the audit is complete, the auditor will send you the assessment and the amount.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I received a Hawaii Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don't have sales tax audit experience, how can you trust that the State's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you thoroughly understand your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Hawaii sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

What to Expect from a Hawaii Sales Tax Auditor

Here is a summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Hawaii sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Hawaii sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

After reviewing all information, the auditor will prepare a proposed audit report which shows preliminary findings, and an initial amount due or refund. The proposed audit report is the basis for discussion between you and the auditor; it is not a final determination. It may be estimated in cases where requested information has not been provided.

Suppose a business buys an item online without paying use tax. In that case, the business is still obligated to remit the tax to Hawaii. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Hawaii Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

The auditor will meet you by phone or in person to present the proposed report and ensure you understand the proposed adjustments.

The auditor will produce an audit report with corresponding work papers to support the Hawaii sales and use tax assessment. After reviewing all the documents, the auditor will explain any adjustments.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Hawaii's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the State because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

In the following sections, we'll cover the process of challenging a Hawaii sales tax audit assessment. HRS (hawaii.gov)

Contesting Audit Findings After the Audit – The Appeal

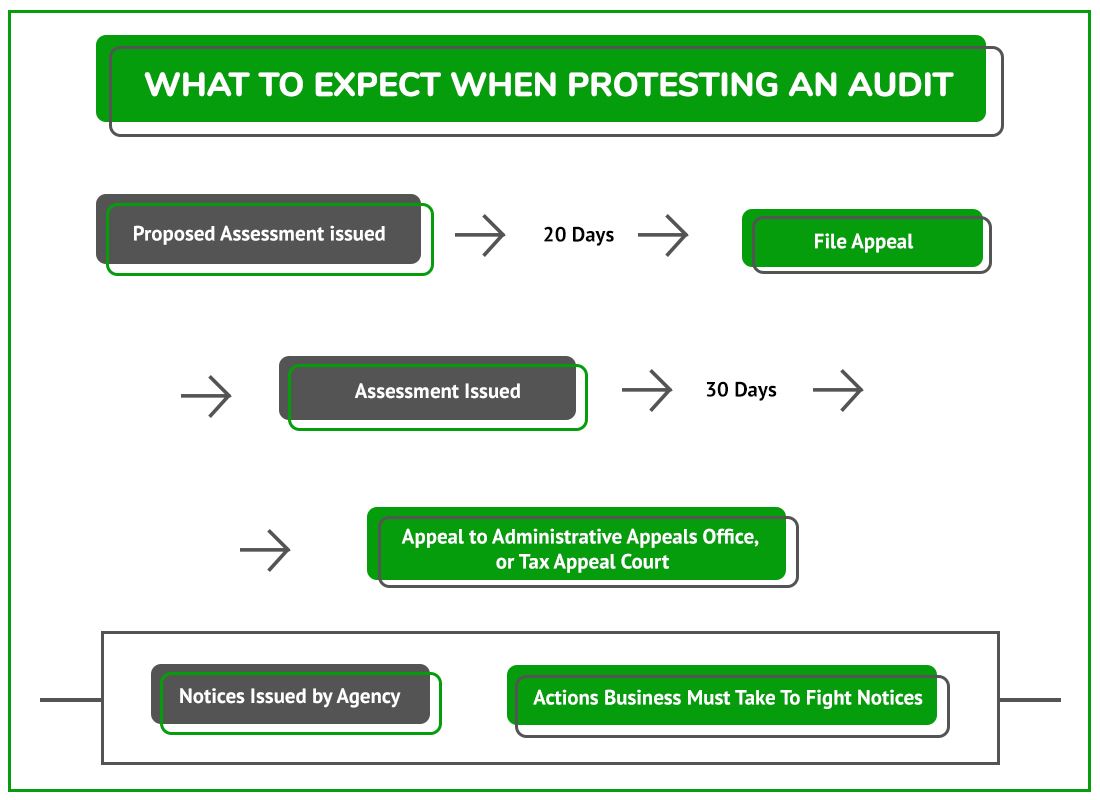

Hawaii Sales Tax Audit Protest Process Flow Chart

NOTE: These deadlines are critical. If missed, getting your case heard can be nearly impossible.

You will receive a Notice of Proposed Audit Report requesting you sign (generally within 30 days) and indicate whether you agree or disagree with the proposed findings.

It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

- Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

You have 30 days from the date the proposed assessment is mailed to submit additional documentation or to dispute the proposed assessment or request an informal conference with the examiner, collector, or auditor.

Appeal/Protest with The Hawaii Administrative Appeals & Dispute Resolution Program (AADR)

Protest Rights and Audit Finding Confirmation

Appealing a Proposed Assessment

If you cannot resolve your dispute, you may apply to the Administrative Appeals & Dispute Resolution Program (AADR) or wait until a final assessment is issued. You must appeal a proposed assessment to AADR within 20 days from the date on the proposed assessment.

The AADR is an informal, streamlined process to resolve tax disputes quickly without litigation. You will not pay any fees when you apply to the AADR.

Appeals to AADR are administered by the Administrative Appeals Office, which is an independent body within the Department. See tax.hawaii.gov/appeals/ for more information.

If AADR accepts your appeal of the proposed assessment, you will not be able to appeal the final assessment to AADR. The board of review or the tax court cannot appeal a proposed assessment to the Board of Review (BOR) or Tax Appeal Court (TAC)

Board of Taxation Review | Department of Taxation (hawaii.gov)

Appealing a Final Assessment

You have 30 days to appeal a final assessment to the BOR, TAC, or AADR. If the AADR accepted your appeal of the proposed assessment into AADR, you would not be able to appeal the final assessment through the AADR.

The Board of Review BOR is an informal forum. The BOR is an independent body that conducts all hearings and makes decisions independently and is attached to the Department only for administrative support. The BOR is made up of ten members who are state residents and are appointed by the governor. You can represent yourself if you choose, or be represented by a tax professional before the BOR. There is no cost to you to file an appeal to the BOR.

The TAC is a court of record, and all filings, proceedings, etc., follow established court procedures and rules. You can represent yourself or be represented by an attorney. Corporations, however, cannot represent themselves before the TAC. Unlike an appeal to the BOR, there are filing fees that you must pay to the TAC to initiate your appeal.

If you have received a Notice Assessment and haven't talked to someone experienced in Hawaii State tax, now is the time. Do it before these deadlines pass.

Final Decision

If the appeal is filed directly to the tax appeal court, you must also serve a court-stamped copy of the notice of appeal to the Director of Taxation within 30 days from the date the Final Notice of Assessment was mailed.

Administrative Hearing with The Tax Appeal Court

There are many ways a case can find its way to the Tax Appeal Court. Generally, filing in the Tax Appeal Court after the assessment issuance of the assessment is usually advisable. If you have also filed in the Hawaii Administrative Appeals Office, most Tax Appeal cases are stayed to resolve the case informally through AAO.

The Tax Appeal Court hears aggrieved taxpayers' cases against the Hawaii Department of Taxation. The Tax Appeal Court is a judicial court and decides questions of fact and law as well as constitutional questions on tax issues. The cases are assigned to the appropriate judge. You may make the first appeal to either the board of review or the tax appeal court without paying the tax assessed.

Because it is a judicial court, having an experienced sales tax lawyer is critical. Although not required, it is strongly encouraged to have an attorney or sales tax professional handle your case at this phase for two reasons:

It can be challenging to get evidence admitted if you have never done so before.

Not developing the case record will likely cost your business as the case proceeds.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Settling a Hawaii Sales Tax Liability

After any critical notices are issued, settling your Hawaii sales tax case with the Hawaii Department of Taxation is possible by filing a Hawaii Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Hawaii tax laws.

DO NOT attempt to negotiate a settlement without an experienced Hawaii state and local tax lawyer or other professional.

Information and Options to Resolve Your State Tax Debt | Department of Taxation (hawaii.gov)

Contest a Hawaii Jeopardy Assessment

Hawaii may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Hawaii Department of Taxation the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Appeal to the Hawaii Supreme Court

You may request a transfer of your case from the Intermediate Court of Appeals to the Hawaii Supreme Court. You must meet strict timelines and criteria for the Hawaii Supreme Court to accept your request to transfer.

The Hawaii Supreme Court will hear your appeal instead of the Intermediate Court of Appeals, if your request is granted,.

Alternatively, you may apply for a writ of certiorari with the Hawaii Supreme Court within 30 days of the Intermediate Court of Appeals issuing a judgment or dismissal order. The Hawaii Supreme Court has the discretion to accept or reject your application.

Other Hawaii Sales Tax Resources

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.