Utah Sales Tax & Audit Guide

Straightforward Answers to Your Utah Sales Tax Questions

- Do I need to collect Utah sales tax?

- Should I be collecting or paying Utah use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Utah.

- Who needs to collect Utah sales and use tax?

Like most states, to be subject to Utah sales tax collection and its rules, your business must:

1) Have nexus with Utah, and

2) Sell or use something subject to Utah sales tax.

How is nexus established in Utah?

Any of the following establishes physical nexus:

You have a physical presence in Utah if you:

1. Have or use an office, warehouse, distribution house, sales house, service enterprise, or other place of business in Utah.

2. Maintain a stock of goods or inventory in Utah.

3. Regularly solicit orders in Utah, even if the orders are not accepted in Utah (unless your Utah activity is only advertising or solicitation by mail, e-mail, the Internet, telephone, etc.).

4. Regularly deliver property in Utah other than by common carrier or U.S. mail; or

5. Regularly lease or service property located in Utah.

Economic Nexus (Wayfair Law) and Internet Sales in Utah

According to the Utah State Tax Commission,retailers, and marketplace facilitators have economic nexus and must collect and pay sales and use tax on their sales and on sales they facilitate on their marketplace if they sell tangible personal property, products transferred electronically, or services for storage, use or consumption in the state and if in either the previous calendar year or the current calendar year, those sales result in either:

- Gross revenue of more than $100,000; or

- Two hundred or more separate transactions.

For additional information, see Business Tax and Use Guide.

How is the $100,000 gross revenue threshold calculated?

Gross revenue includes all taxable sales into the state in the current or prior calendar year.

Which sales are subject to Utah sales tax?

General Transactions

If you have nexus in Utah, the next step is determining whether the products or services you sell are subject to Utah sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Utah sales tax.

The rules seem simple, but many details make applying Utah’s tax rules to your business challenging. We recommend scheduling a timeto review your specific situation with one of our sales tax professionals.

Common Exemptions from Utah Sales and Use Tax:

Exemptitems include:

- Prescription Drugs

- Oxygen and Anesthesia Gases

- Medical Devices, Equipment, and Supplies

- Durable Medical Equipment includes equipment for home use, including repair and replacement parts.

- Mobility-Enhancing Equipment includes equipment sold under a doctor's written prescription, including repair and replacement parts.

- Seeds for Planting

- Textbooks (under specific conditions; see page 11 Publication 25)

- Magazine Subscriptions

- Coin-Operated Machines

Services

The Utah Tax Commission taxes certain services, such as charges for labor to repair, renovate or clean tangible personal property, which is taxable. See Publication 25, General Sales Tax Information, for details.

The following transactions are taxable unless an exemption applies:

- Retail sales or purchases of tangible personal property and products transferred electronically within Utah.

- The storage, use, or consumption of tangible personal property and products transferred electronically in Utah.

- Rentals and leases of tangible personal property and products transferred electronically, if:

- the location of the product is in Utah;

- the lessee took possession of the product in Utah; or

- the product is stored, used, or otherwise consumed in Utah.

- Labor to repair, renovate and clean tangible personal property and products transferred electronically. This includes maintenance agreements.

- Labor to repair, upgrade or maintain products transferred electronically. This includes maintenance agreements.

- Laundry and dry-cleaning services when the buyer does not perform the labor.

- Admission or user fees for theaters, movies, operas, museums, planetariums, shows, exhibitions, concerts, carnivals, amusement parks, amusement rides, circuses, menageries, fairs, races, contests, sporting events, dances, boxing matches, wrestling matches, closed-circuit television broadcasts, billiard parlors, pool parlors, bowling lanes, golf, miniature golf, golf driving ranges, batting cages, skating rinks, ski lifts, ski runs, ski trails, snowmobile trails, tennis courts, swimming pools, water slides, jeep tours, horseback rides, sports activities, or any other amusement, entertainment, recreation, exhibition, cultural, or athletic activity. User fees include access charges for videos, video games, television programs, and cable or satellite broadcasts if that access occurs anywhere other than the buyer's home.

- Use of assisted amusement devices when the buyer does not operate the device or ride.

- Assisted cleaning or washing of tangible personal property if the buyer does not perform the cleaning or washing labor.

- Stays at tourist homes, hotels, motels, campgrounds, trailer courts, and similar accommodations usually rented for less than 30 consecutive days.

- In-state telecom services.

- Meals (prepared food) at restaurants or other eating places.

- Sales for commercial use of gas, electricity, heat, coal, fuel oil, or other fuels. (Sales of these items for industrial use may qualify for an entity-based exemption.)

- Sales for residential use of gas, electricity, heat, coal, fuel oil, or other fuels. These products are taxed at the state rate of 2 percent plus any applicable local and/or public transit tax.

- Sales of grocery food are taxed statewide at 3 percent.

- Sales of prepared food are taxed at the full combined rate.

- Sales of prepaid telephone calling cards, including vending machine sales of prepaid telephone calling cards, if the card can be used for in-state calls.

- Sales of memberships that entitle the buyer to discounted or free merchandise or services subject to sales tax.

For example:

1. Memberships that let cardholders enter a warehouse and buy merchandise free of additional markup.

2. Video memberships that let members rent videos at a reduced price. All purchases made with these membership cards are subject to sales tax at the time of purchase unless an exemption applies.

• Sales of products transferred electronically if a physical copy of the product would be taxable. For example, purchasing a music CD is taxable, so downloaded music is also taxable.

Software

Many people have questions about the taxability of Software as a Service (SaaS).

Many states already impose a tax on Software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

You can find more details about Utah sales tax and Software as a Service here, but we've provided the basic information below to help you get started.

Custom software

Custom software is written for the needs of a specific customer. According to the Utah Tax Commission, custom software is not tangible personal property. Therefore, sales, rentals, leases, and charges for using custom software are nontaxable. Charges to maintain, support, or upgrade custom software are also nontaxable.

Under Utah law, tangible personal property includes prewritten Software. Therefore, sales, rentals, leases, and charges for using prewritten Software in Utah are taxable regardless of delivery method (boxed, hosted, downloaded, etc.). Charges to upgrade prewritten Software are also taxable.

Remotely accessed Software

Remotely accessed Software includes hosted software, application service provider (ASP) software, software-as-a-service (SAAS), and cloud computing applications. License fees for remotely accessed prewritten Software are taxable if the purchased Software is used in Utah.

Shipping & Handling

If the delivery charge is separately stated on the invoice to the customer, the delivery charge is not subject to sales or use tax.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Utah Tax Commission provides some specific guidance for the following industries:

- Sales Tax Information for Sales, Installation, and Repair of Tangible Personal Property Attached to Real Property

- Sales Tax Information for Nurseries, Florists, Landscapers, and Related Industries

- Sales Tax Information for Health Care Providers

- Sales Tax Information for Public Utilities

- Sales Tax Information for Restaurants

- Sales Tax Information for Lodging Providers

- Sales Tax Information for Telecommunications Service Providers

- Sales Tax Information for Computer Service Providers

- Sales Tax Information for Guides and Outfitters

Determining Local Sales Tax Rates in Utah

The Utah sales tax rate is 4.85% for most retail sales, with the following exceptions:

The state sales tax rate for grocery food is 1.75 percent. These transactions are also subject to local and county options and result in a total combined rate on grocery food of 3 percent throughout Utah.

The state sales tax rate for residential fuel is 2 percent, resulting in a combined rate of 2.85 percent less throughout Utah.

See the next section for information about additional local tax rates.

Local Sales and Use Tax Tables

Here you can look up local Utah sales tax rates. Or find your city’s local tax rate in the chart below:

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Utah Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement

in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Utah sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Utah and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Utah's lookback period: The standard lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

What to Expect During an Audit

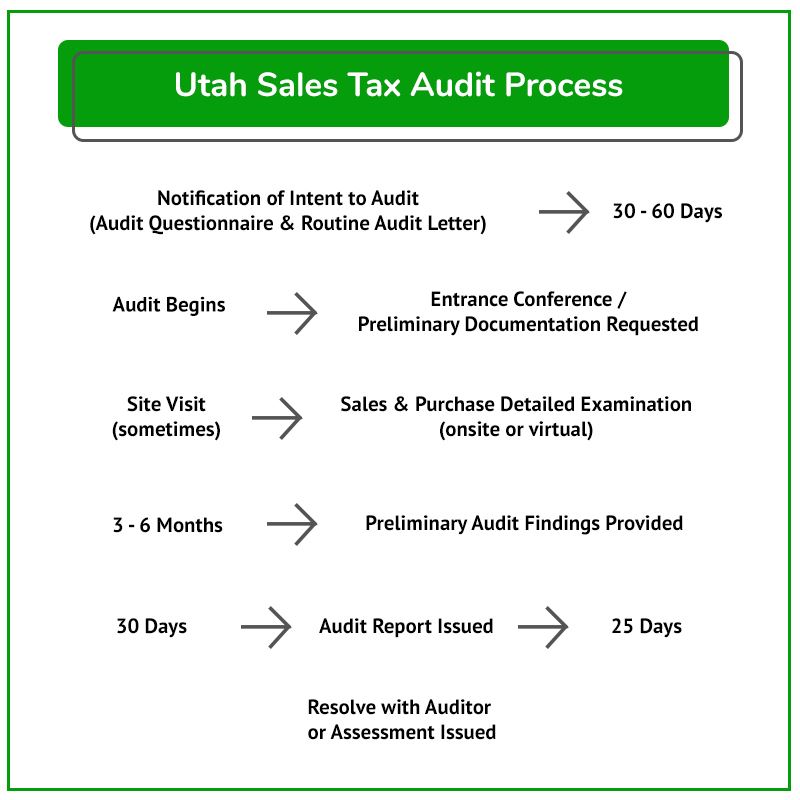

The typical audit process is shown in this flowchart. Detailed guidance for each stage of the process follows in the sections below.

Utah regularly audits businesses required to charge, collect, and remit various taxes in the state. Many audits begin with a call from a Utah Tax Commission sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Utah sales tax audit.

A Notice of Determination stating the reason for the assessment and the amount will be sent to you by the Tax Commissioner no later than 12 months from the commencement of the audit.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I Received a Utah Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don’t have sales tax audit experience, how can you trust that the state's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you thoroughly understand your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Utah sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from a Utah Sales Tax Auditor

Here is a summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Utah sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Utah sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

If a business buys an item online without paying use tax, the business is still obligated to remit the tax to Utah. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Utah Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the Utah sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Utah's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We'll cover the process of challenging a Utah sales tax audit assessment in detail in the following sections.

Contesting Audit Findings with the Auditor

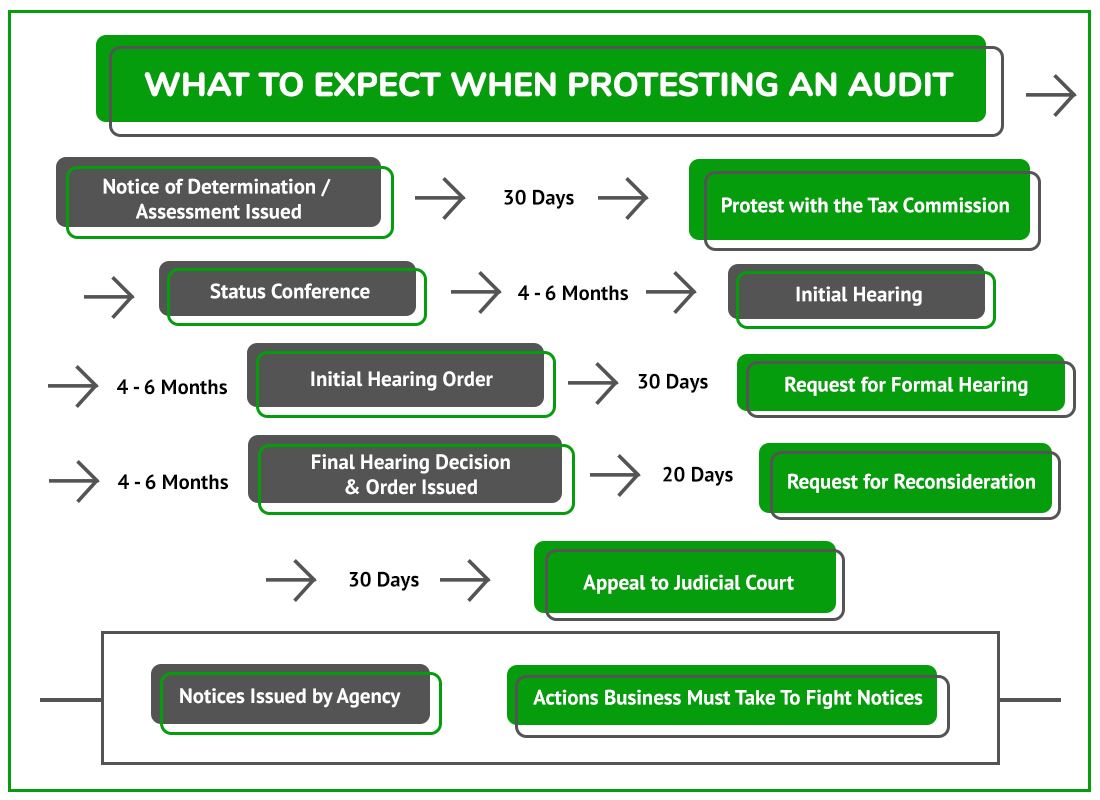

Utah Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, it can be tough to get the case reopened.

After an audit, the auditor will issue a Notice of Determination (AKA the audit report). It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you disagree with the proposed changes, you may request an informal conference with the auditor. You must request an informal conference and attempt to resolve the case with the auditor.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

1. Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage.

After this conference, the auditor will adjust the audit assessment, and a Notice of Determination will be issued.

If you cannot resolve this with the auditor, the next step is to appeal/protest the issue.

Appeal/Protest with The Utah Tax Commission

You have the right to protest, stating your disagreement with the assessment, within 30 days of the assessment.

Protest Rights and Audit Finding Confirmation

If you disagree with an audit's findings, you must file an appeal 30 days from the Notice of Determination/Assessment date. The appeal must state why the assessment, the tax, interest, or penalties are incorrect.

The appeal results in an informal initial hearing in front of the Utah Tax Commission. While the hearing is under the Administrative Procedures Act (APA), it is often heard by the Tax Commissioner’s office, but sometimes by an ALJ. While you may handle the case yourself, it is usually wise to have an experienced sales tax lawyer or professional represent you during these proceedings.

The initial hearing proceedings result in an Initial Hearing decision, which is appealable by requesting a formal hearing within 30 days. While the Initial Hearing is waivable, it is generally not advisable to skip this step in the process.

If you have received a Notice of Deficiency and haven't talked to someone experienced in Utah State tax, now is the time. Do it before these deadlines are missed.

Administrative Hearing with The Utah Tax Commission

If you disagree with the initial hearing decision or you waive the initial hearing, the case proceeds to the Formal Hearing Division.

Like any hearing, it is possible to represent yourself. However, the formal hearing is your last shot to resolve your sales tax matter before going to judicial court, and it is highly advisable to have a sales tax pro in your corner. Even though your case is still being heard within the Tax Commission, the deadlines and rules of evidence are strictly enforced during the formal hearing.

To achieve the most favorable outcome, it is critical to present the evidence and develop the case record. Our team has decades of experience representing businesses in administrative court.

After the hearing, a decision and order is rendered by the administrative law judge or Tax Commissioner, who presided over the case. Either party has 20 days to ask for redetermination is something was not considered. At the completion of the reconsideration process or directly after the formal hearing decision is issued, either party may seek judicial review (judicial court) of the decision. An appeal to Utah District Court, removes the case from the agency and gets you into judicial court.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Settling a Utah Sales Tax Liability

After any critical notices are issued, settling your Utah sales tax case with the Utah Tax Commission is possible by filing a Utah Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Utah tax laws.

DO NOT attempt to negotiate a settlement without an experienced Utah state and local tax lawyer or other professional.

Contest a Utah Jeopardy Assessment

Utah may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Utah Tax Commission the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Suppose you can't resolve the case within the agency. There's still one chance to fight your Utah sales tax assessment - Utah District Court. We don't generally recommend it, but you always have the option to skip the agency protest process and file it in tax court. Neither party wants to spend the time and resources on the uncertainty of the tax court. So, challenging the assessment can effectively maximize your settlement potential, but, at this stage, it is imperative that you have an experienced representative.

Other Utah Sales Tax Resources

Utah Sales and Use Tax Guide 2022

Utah Tax Commission Sales Tax Website

If you have received a Notice of Assessment and haven't talked to someone experienced in Utah State tax, now is the time. Do it before these deadlines are missed.

Reviews

-

"Jerry Provided Calming, Clear Guidance"

I can't say enough about Jerry and STH. We were in a bit of a panic re reaching nexus levels and dealing with reseller tax ...

- Mike L. -

"My Entire Experience Was Superior"

My entire experience from intake to resolution with Sales Tax Helper was superior. '11' on a scale of 1-10! Initial meeting ...

- Tim N. -

"Prompt, Courteous & Helpful!"

I sincerely am grateful for the prompt, courteous, and helpful that has been offered me by Sales Tax Helper. My agent, Alex ...

- Carol M. -

"Professional and Very Communicative"

When my business needed guidance with sales and use tax, I reached out to Sales Tax Helper through their website and received ...

- Pierce L. -

"They Are Experts in Their Field"

Jerry & Alex are excellent at what they do. They helped me navigate some very difficult and stressful situations. They’re ...

- Greg M. -

"Excellent Team to Work With!"

The team at Sales Tax Helper was excellent to work with. I had a complex business sales tax challenge that they methodically ...

- Mike M. -

"Always Provide Accurate & Prompt Responses"

Alex and Jerry always provide very accurate and prompt responses to my inquiries regarding the sales tax. They also bring ...

- Lukas P. -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O.