New Jersey Sales Tax & Audit Guide

Straightforward Answers to Your New Jersey Sales Tax Questions.

- Do I need to collect New Jersey sales tax?

- Should I be collecting or paying New Jersey use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in New Jersey.

Who Needs to Collect New Jersey Sales and Use Tax?

Like most states, to be subject to New Jersey sales tax collection and its rules, your business must:

1) Have nexus with New Jersey, and

2) Sell or use something subject to New Jersey sales tax.

How is Nexus Established in New Jersey?

According to the New Jersey Division of Taxation, sales tax nexusis created in New Jersey if a business has a physical presence in New Jersey, such as:

1. Selling, leasing, or renting tangible personal property, specified digital products, or services.

2. Maintaining an office, distribution house, showroom, warehouse, service enterprise (e.g., restaurant, entertainment center, business center, etc.), or another place of business.

3. Having employees, independent contractors, agents, or other representatives (including salespersons, consultants, customer representatives, service or repair technicians, instructors, delivery persons, and independent representatives or solicitors acting as agents of the business) working in the State.

4. Selling, storing, delivering, or transporting energy (natural gas or electricity) to users or

customers.

5. Collecting initiation fees, membership fees, or dues for access to or use of health, fitness.

athletic, sporting, or shopping club property or facilities.

6. Parking, storing, or garaging motor vehicles.

7. Delivering goods sold in seller’s own vehicle.

Additionally, businesses that do not have a physical presence in New Jersey can establish economic nexus by exceeding a certain annual sales threshold in New Jersey. See the next section for details.

Economic Nexus (Wayfair Law) and Internet Sales in New Jersey

New Jersey introduced a new dollar-based standard for businesses with no physical presence in New Jersey. This is known as economic nexus.

A remote seller is one who sells tangible personal property, specified digital products, or taxable services for delivery into a state via the Internet, catalog, or telephone, and has no physical presence in that state. As a result of the Wayfair decision, states may now impose Sales Tax collection and remittance obligations on remote sellers.

For sales made on and after November 1, 2018, a remote seller that makes a retail sale of tangible personal property, specified digital products, or taxable services delivered into New Jersey must register, collect, and remit New Jersey Sales Tax if the remote seller meets either of the following criteria (the economic threshold):

- The remote seller's gross revenue from sales of tangible personal property, specified digital products, or taxable services delivered into New Jersey during the current or prior calendar year, exceeds $100,000; or

- The remote seller sold tangible personal property, specified digital products, or taxable services delivered into New Jersey in 200 or more separate transactions during the current or prior calendar year.

- A remote seller who doesn’t meet either of the above criteria does not need to collect and remit New Jersey Sales Tax. For more information, you can refer to the New Jersey Sales Tax FAQ for Remote sellers.

How is the $100,000 gross revenue threshold calculated?

To calculate the $100,000 gross revenue threshold, include all sales of tangible personal property, specified digital products, and taxable services delivered into New Jersey including nontaxable retail sales of tangible personal property, and specified digital products.

Marketplace Sellers

- If your business sells through Amazon or a similar marketplace provider, you may not have to collect sales and use tax on those sales. Specifically, if the marketplace provider certifies that they are collecting and reporting sales tax, you are off the hook. However, such sales may still count towards your total sales threshold, meaning you’ll still need to collect tax on sales made directly through your website or any other marketplaces that don’t collect sales tax on your behalf. Here is some additional information for marketplace sellers: New Jersey Sales Through a Marketplace

Terminating New Jersey Sales Tax Collection

A common question from remote sellers regarding New Jersey sales tax collection is whether you must indefinitely collect sales tax after initially surpassing the economic nexus threshold. The answer is no.

Businesses can request to be on a non-reporting basis if any of the following apply:

- The business does not make any sales of tangible personal property, specified digital products, or services subject to sales tax, and has not had a use tax liability averaging over $2,000 during the past three years.

-

- (Note: Businesses whose annual use tax liability exceeded $2,000 for three previous years must be on a reporting basis for Sales and Use Tax.

- Businesses with no taxable sales, who did not have a use tax liability exceeding that threshold, may report their use tax liability on an annual ST-18B.)

-

- The business qualifies as a remote seller and all sales are made through a marketplace facilitator.

- The business is a remote seller making only exempt or nontaxable sales.

It’s important to note that just because you terminate your New Jersey sales tax collection doesn’t mean you’re 100% off the hook. New Jersey still requires you to comply with its recordkeeping requirements, and you are still subject to their sales tax audits.

To request that your business be placed on a non-reporting basis for Sales and Use Tax. File Form C-6205-ST.

Which Sales are Subject to New Jersey Sales Tax?

General Transactions

If you have nexus in New Jersey, the next step is to determine whether the products or services you sell are subject to New Jersey sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to New Jersey sales tax.

The rules seem simple, but many details make applying New Jersey’s tax rules to your business challenging.

We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from New Jersey Sales and Use Tax:

Tax-exempt items include:

- Unprepared food for human consumption

- Certain professional and personal services

- Real estate sales

- Most clothing and footwear

- Disposable paper products for household use

- Prescription drugs

- Over-the-counter drugs

- Dietary supplements

- Mobility enhancing equipment

Services

The New Jersey Sales and Use Tax Act imposes a tax on the receipts from every retail sale of tangible personal property, specified digital products, and the sale of certain services, except where specifically exempted. In addition, most services performed on tangible personal property and specified digital products are taxable unless they are specifically exempted by law. Here’s more information on the taxable status of specific services in New Jersey:

- Professional Photographers

- Auctioneers

- Landscapers

- Auto Repair Shops

- Air Conditioning, Heating, Refrigeration

- Veterinarians

- Printing & Publishing

- Barber & Beauty Shops

- Cemeteries and Funerals

- Motor Vehicle Parking, Storing, & Garaging

- Limousine Services

- Massage, Bodywork, And Somatic Services

- Investigation and Security Services

- Information Services

Additional information can be found here.

Software

Prewritten Software

The retail sale of prewritten software is taxable. The sale of a license to use prewritten software is also taxable. The use in New Jersey of prewritten computer software purchased at retail without payment of sales or use tax is subject to use Tax.

There is one exception to the taxability of prewritten software delivered electronically:

Sales of prewritten software delivered electronically are exempt if the software is to be used directly and exclusively in the conduct of the purchaser’s business, trade, or occupation. N.J.S.A. 54:32B-8.56.

However, this exception does not apply in the following circumstances:

- Load and Leave Software: Suppose a seller sends a service representative to a customer’s New Jersey location to install prewritten or modified software. However, the tangible storage medium (CD, disc) is not left with the customer. In that case, the transaction is not considered the sale of tangible personal property delivered electronically and therefore is not exempt, even if the software is to be used directly and exclusively in the conduct of the purchaser’s business, trade, or occupation.

- Conversely, suppose the purchaser of software initially delivered electronically also receives tangible storage media containing the software. In that case, the transaction is not considered a sale of software delivered electronically and is not exempt, even when the software is used directly and exclusively in the purchaser’s business.

Custom Software

The purchase of entirely custom-made software for use by only the purchaser is treated as a nontaxable professional service transaction and is not subject to Sales Tax.

Software as a Service (SaaS)

Software as a Service SaaS is not tangible personal property. Unlike prewritten computer software, which is delivered electronically, SaaS only provides the customer with access to the software. SaaS providers fully retain and operate the software applications to which they sell access, and customers only have access to the software through remote means.

Because the software is not “delivered electronically,” and SaaS customers do not receive title or take possession of the software, it is not the sale of tangible personal property, and therefore is not subject to sales tax.

However, SaaS providers must pay Sales Tax on the purchase of any software used to provide the service, except where the business use exemption is applicable.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

Shipping & Handling

New Jersey Sales Tax is imposed on the charges for delivery of property (or services) from a seller directly to a customer if the items sold are subject to tax. Tax is not imposed on delivery charges for nontaxable items.

To comply with New Jersey Sales Tax regulations, sellers are required to collect sales tax on delivery charges.

- If combined shipping includes both taxable and nontaxable products, only the portion of the delivery charge that relates to the taxable property is subject to Sales Tax.

- The delivery charge must be allocated by using a percentage of total sales price or total weight that reflects the total taxable property in the shipment.

- If the seller doesn’t itemize the delivery charge, the entire delivery charge is taxable

Remember: The taxability of delivery charges follows the taxability of the property or services sold.

Industry Specific Guidance

While the general sales tax rules seem straightforward, the application of those rules can get tricky when gray areas come up. The New Jersey Division of Taxation provides some specific guidance for the following:

- Floor Covering Dealers

- Arts & Crafts Businesses

- Flea Markets

- Vending Machines

- Newspapers, Magazines, Periodicals and NJ Sales Tax

- Space for Storage

- Specified Digital Products

- Coupons, Discounts

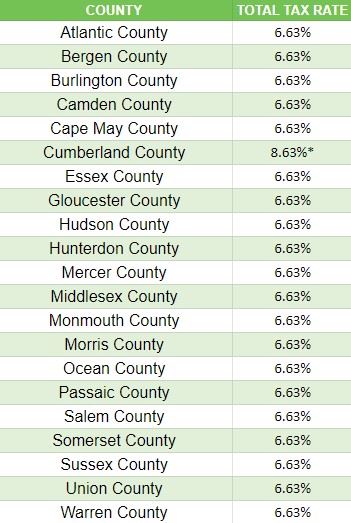

Determining Local Sales Tax Rates in New Jersey

New Jersey ’s base statewide sales tax rate is 6.625%.

An Occupancy Fee of 5%(3.15% in Wildwood, Wildwood Crest, and North Wildwood; 1% in Newark, Jersey City, and Atlantic City) is imposed on the rent for every occupancy of a room in a hotel, motel, and transient accommodations such as short-term rentals of rooms, homes or other lodging or similar facility in most New Jersey municipalities.

A 3% Municipal Occupancy Tax may also be imposed by any New Jersey municipality other than Newark, Jersey City, Atlantic City, Wildwood, Wildwood Crest, and North Wildwood.

*Cape May County Tourism Sales Tax

Certain businesses in Cape May County must collect a 2% Tourism Sales Tax on tourism-related retail sales in addition to the State Sales Tax.

In addition to the Tourism Sales Tax, the rent for hotels, motels and transient accommodations such as short-term rentals of rooms, homes or other lodging or similar facility is subject to a Tourism Assessment of 1.85% and a State Occupancy Fee of 3.15%.

Local Sales and Use Tax Tables

The following tax table shows the additional taxes charged by each county and city.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected New Jersey Sales Tax, But I Didn't

Many of our competitors will suggest Filing a Voluntary Disclosure Agreement in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus, but you have not collected New Jersey sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best solution for a business is to register with New Jersey and pay back taxes, penalties, and interest.

Be wary of the tax professionals that recommend doing a VDA in these cases. They are looking to make a buck rather than looking out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our New Jersey tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

New Jersey’s lookback period: The standard lookback period is four years or 16 quarters for returns filed quarterly.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to four years. Suppose you should have collected sales tax over the past ten years but didn't. If that is the case, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

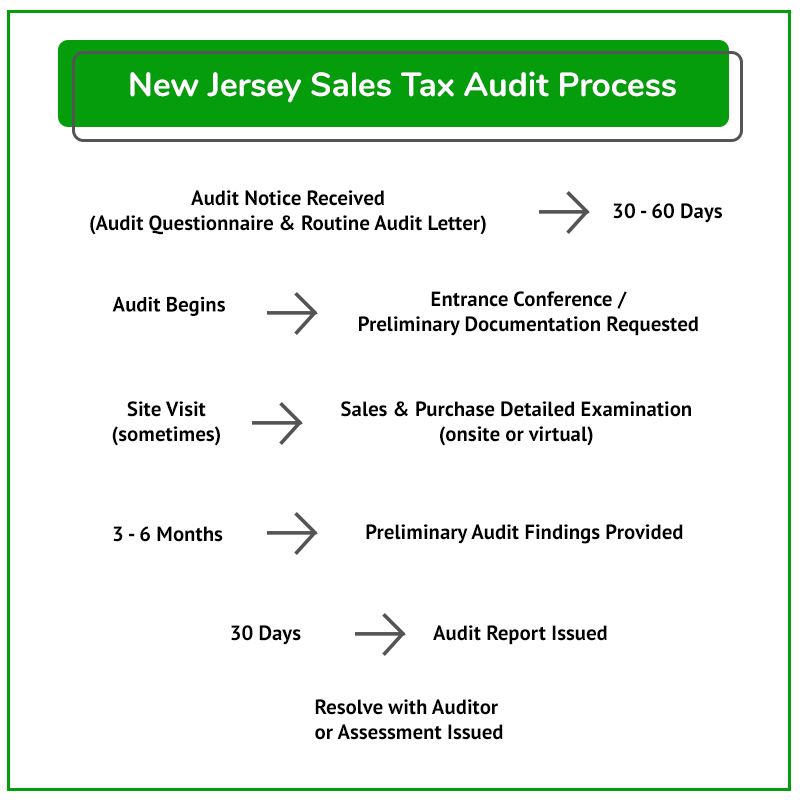

What to Expect During an Audit

The typical audit process is shown in this flowchart. Detailed guidance for each stage of the process follows in the sections below.

New Jersey regularly audits businesses required to charge, collect, and remit various taxes in the New Jersey.

Many audits begin with a call from a New Jersey Department of Revenue's sales tax auditor.

Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a New Jersey sales tax audit.

It is good to start with getting a New Jersey and local tax professional involved to prepare for the audit.

I Received a New Jersey Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don’t have sales tax audit experience, how can you trust that the New Jersey’s auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your New Jersey sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from a New Jersey Sales Tax Auditor

If you want to know what to expect from an auditor, it can be helpful to see things from their perspective. What better way to do that than to read the playbook they use to conduct an audit? With that in mind, here is the New Jersey Manual of Audit Procedures for your review.

It's quite a lengthy read, so we've summarized the process below.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

For now, here is the summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your New Jersey sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your New Jersey sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-New Jersey sales.

- Conduct a use tax audit – the auditor will request documents of accounts to make sure use tax was paid adequately on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

| If a business buys an item online without paying sales tax, the business may still be obligated to remit use tax to New Jersey. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on New Jersey Use Tax. |

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the New Jersey sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied New Jersey’s sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying New Jersey because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We'll cover the process of challenging a New Jersey sales tax audit assessment in detail in the following sections.

Contesting Audit Findings with the Auditor

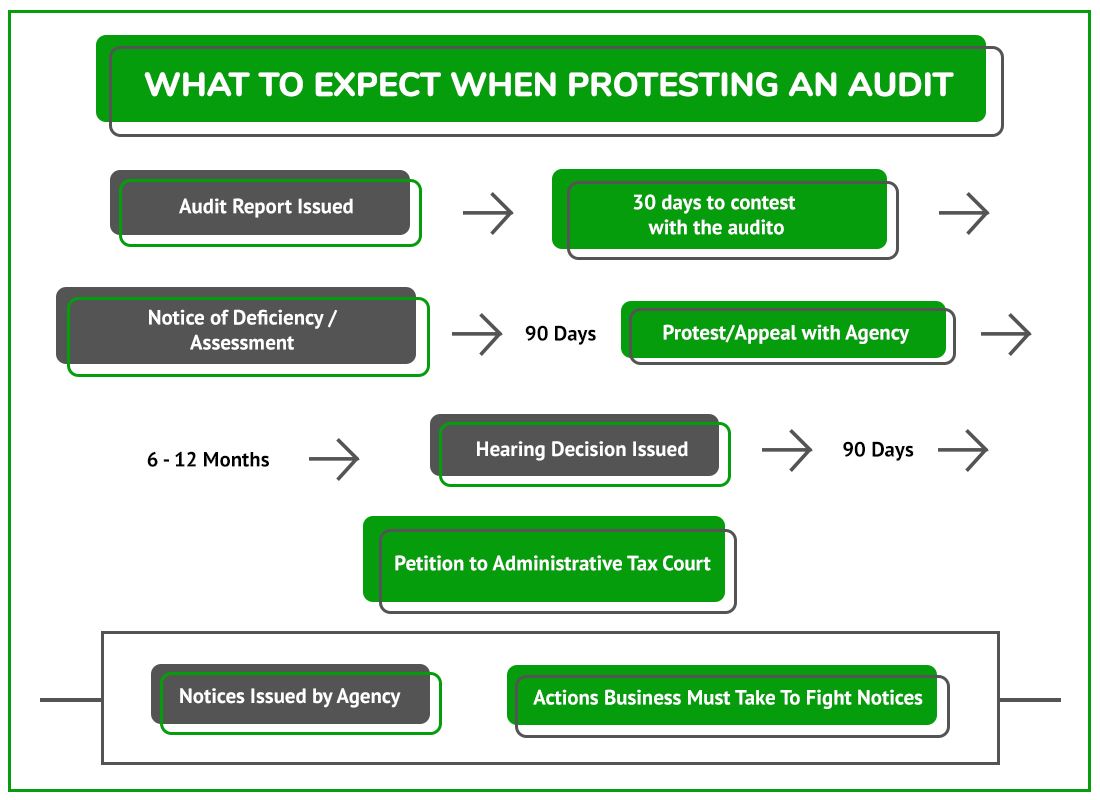

New Jersey Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be very difficult to get the case reopened.

After an audit, the auditor will issue a proposed assessment or audit report. This document details the auditor’s findings so it’s important to carefully review and understand its implications.

If, after discussing the areas of contention, the taxpayer still disagrees with the audit findings or any issue of fact or law, the auditor will advise the taxpayer of their right to discuss the matter or meet with the auditor’s supervisor.

The auditor will then list:

• Specific issues of fact or law discussed with the taxpayer.

• Laws, rules, or regulations supporting the auditor’s determinations and whether the taxpayer agrees or disagrees; and

• The methods the auditor used to make the determinations and whether the taxpayer agrees or disagrees.

Audit Closing Conference

After reviewing and finalizing the work papers, the auditor will schedule a closing conference.

The auditor provides the draft audit results during this conference.

During the conference, the auditor will:

- Explain any proposed audit adjustments to the taxpayer.

- After explaining the results, the auditor will provide a due date for any further adjustments.

Any issues with the results are handled as follows:

The auditor will consider the taxpayer’s disagreements if any; decide whether they have merit, and adjust accordingly. The taxpayer generally has 30 days to examine the proposed adjustments before the auditor finalizes them.

However, if there is not enough time before the statute of limitations will expire, the auditor may have to finalize the adjustments immediately or give the taxpayer less than 30 days to examine the proposal, unless the taxpayer agrees to sign a consent form extending the statute of limitations for assessment.

- Auditee has 30 days to contest findings with the auditor.

- Documentational issues (exemption certificates, proof tax was paid, etc.) and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

- At this point, the auditor will either issue revised proposed adjustments, or determine that no changes are warranted, or finalize the original adjustments.

- Regardless of the path taken, the auditor will re-send the case through the review process for approval, either as a revised proposal, no-change, or a final determination.

- Audit Billings will send a notice to the taxpayer to explain the Final Determination and appeal rights.

If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the New Jersey Conference and Appeals Branch.

Appeal/Protest with The New Jersey Department of Revenue

Protest Rights and Audit Finding Confirmation

Any contested issues that were unresolved prior to the audit report being issued can be protested/appealed by the auditee. This is done after the New Jersey Division of Taxation issues the Notice of Deficiency/Audit Assessment.

You have the right to protest an Audit Assessment if you disagree with it.

First, inform the auditor assigned to your case that you disagree with the assessment:

- Clearly state the reason(s) why you disagree; and

- Provide all necessary documentation supporting your position.

If you are still not satisfied after contacting your auditor, you have the right to appeal. If you disagree with a determination made by the Division, you may:

- File a written protest and request an informal administrative conference with the Conference and Appeals Branch*

- You must send your request within 90 days of the determination date;

- You may represent yourself at the conference or choose another individual to represent you;

- You may file a refund claim on Form A-1730:

- For tax periods starting on or after January 1, 1999; and

- If you paid the entire assessment within one year after the time to protest or appeal has expired; and

- If you file within 450 days after the time to protest or appeal has expired.

- File an appeal with the required fee to the Tax Court of New Jersey.

- The Tax Court must receive your appeal within 90 days of the Notification of Deficiency issuance.

- A protest/appeal must be done within 90 days of the Notification of Deficiency issuance.

If you have received a Final Determination and haven't talked to someone who has experience with New Jersey state and local tax, now is the time. Do it before these deadlines are missed.

Final Decision

If you cannot resolve the New Jersey sales and use tax dispute through the protest/appeal process, the New Jersey Division of Taxation will issue a final determination.

This Notice gives you the opportunity to file in New Jersey ’s tax/administrative court, which is called the New Jersey Tax Court. There are important deadlines in this phase of the process as well, such as 90 days to file in Tax Court.

Settling a New Jersey Sales Tax Liability

Along the way, or even after one of the critical notices are issued, there is the possibility to settle your New Jersey sales tax case by negotiating with the New Jersey Division of Taxation. Often, you can get better results here than with the auditor.

Without solid experience with state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements.

DO NOT try to negotiate a settlement without an experienced New Jersey state and local tax lawyer or other professional.

Contest a New Jersey Jeopardy Assessment

New Jersey may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives New Jersey Division of Taxation accelerated rights and it may immediately begin to try and collect.

To contest a jeopardy assessment, first, you must immediately pay the warrant amount. Then you have 90 days from the date of the action to appeal the Jeopardy Assessment. For more information, read your appeal rights.

New Jersey Tax Court

If you cannot resolve the case within the agency or missed your deadlines, you still have one last shot to fight your New Jersey sales tax assessment by going to the New Jersey Tax Court.

Although we generally don’t recommend it, you always have the option to skip the agency protest process and file it in Tax Court. That said, because neither party wants to spend the time and resources on the uncertainty of tax court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

If your case is filed in tax court, and the case proceeds to a hearing, it is heard and decided by a neutral tax court judge. It is similar to a court hearing, and having an experienced representative is imperative.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other New Jersey Sales Tax Resources

The Business Registration Application (Form NJREG)

New Jersey Department of Revenue

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.