Indiana Sales and Use Tax & Audit Guide

This guide is for businesses that need straightforward answers on the following Indiana Sales and Use Tax subjects:

- Do I need to be collecting Indiana sales tax?

- Should I be collecting or paying Indiana use tax?

- What do I do if I should have been collecting but haven’t?

- I received an audit notice, what should I do?

- Guidance on fighting a sales tax assessment in Indiana.

Who Needs to Collect Indiana Sales and Use Tax?

Like most states, to be subject to Indiana sales tax collection and its rules, your business must:

1) Have nexus with Indiana, and

2) Sell or use something that is subject to Indiana sales tax.

How Is Nexus Established in Indiana?

According to the Indiana Department of Revenue, sales tax nexus is created in Indiana if a business has a physical presence in Indiana, such as:

- Occupying and maintaining an office, distribution center, warehouse, or physical location where business is conducted.

- Having independent sales reps, employees, or agents conducting business in the state, including selling, delivering, or taking orders for taxable items in Indiana.

- Assembling, installing, servicing, or repairing products in Indiana.

- Owning, renting, or leasing real property or tangible personal property in Indiana, including a computer server or software to solicit orders for taxable items.

- Delivering goods to Indiana customers using your company-owned or leased truck.

- Maintaining inventory in Indiana using a third-party fulfillment service, such as Fulfilled by Amazon (“FBA”).

Additionally, business that do not have a physical presence in Indiana, can establish economic nexus by exceeding a certain annual sales threshold in the state. See the next section for details.

Economic Nexus (Wayfair Law) and Internet Sales in Indiana

Effective October 1, 2018, Indiana requires that an out of state business (a.k.a. remote seller) register with the Indiana Department of Revenue to collect and remit sales and use tax if the business has gross sales revenue in the state of either:

- $100,000 or more of sales in the current or preceding calendar year, or

- The business has made 200 or more transactions in Indiana in the current or preceding calendar year.

Gross sales revenue, as defined by Indiana, includes the following:

- Taxable and untaxable sales, including tax exempt sales. This includes any combination of tangible personal property, products transferred electronically, and services provided.

- Gross revenue and transaction count must include the aggregate sum of all sales made on all mediums, including all marketplaces and the remote seller's own website.

Indiana Sales Made Through Marketplace Providers

If your business sells on Amazon or a similar marketplace provider, you may not have to collect sales and use tax on those sales. Specifically, if the marketplace provider certifies they are collecting and reporting sales tax on your behalf, you are off the hook. However, such sales do count towards your total sales threshold, potentially requiring your business to collect tax on sales made directly through your website or other marketplaces.

Which Sales Are Subject to Indiana Sales Tax?

General Transactions

If you have nexus in Indiana, the next step is to determine whether the products or services you sell are subject to Indiana sales and use tax. Like most states, unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Indiana sales tax.

While the general rules seem straightforward, the application of Indiana’s sales tax rules and their nuances, complexities, and application to your business can get complicated. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common exemptions from Indiana sales and use tax:

- Groceries

- Agricultural Production Exemptions

- Aircraft Repairs

- Medicines

- Common household remedies

Services

Generally, services are not subject to Indiana sales tax. However, the types of services listed here are subject to Indiana sales tax:

- Photography, video and other similar services when TPP is transferred.

- Telecommunications Services

Software

Indiana generally does not tax SaaS. Likewise, software is generally not taxable unless it is canned software or applications. However, if the software is remotely accessed it is not subject to sales tax.

Shipping & Handling

Indiana has unusual rules on the taxability of shipping and handling, but we’ve paired it down to what you really need to know here:

- Transportation, shipping, crating, handling, packing and postage charges that are separately stated on the invoice are NOT taxable IF the shipper/carrier is USPS.

- If another shipper (such as FedEx or UPS) is used, then the shipping and handling charges are taxable regardless of whether they are separately stated on the invoice.

Specific Industries

While the general sales tax rules seem straightforward, the application of those rules can get tricky when gray areas come up. These guides were developed by the Indiana DOR to provide some industry specific guidance.

- Indiana Sales Tax Guide for Remote Sellers and Marketplace Facilitators

- IDOR Streamlined Sales and Use Tax Guide

- Indiana Sales Tax Exemptions for Agricultural Industry

- Indiana Sales Tax Guide for the Sales and Use of Computer Hardware, Software, and Digital Goods

- IDOR Sales Tax Guide for Products Transferred Electronically

- Indiana Sales Tax Guide for Warranties and Maintenance Contracts

- Indiana Sales Tax Guide for Food Services

- Indiana Sales Tax Guide for Restaurants

- Indiana Sales Tax Guide for the Sales of Food

- Indiana Sales Tax Guide for Vending Machine Sales

- Indiana Sales Tax Guide for Dry Cleaners and Laundry Services

- Indiana Sales Tax Guide for Barbers and Beauticians

- Indiana Sales Tax Guide for Auto / Car Dealers

- Indiana Sales Tax Guide for Auto / Car Sales

- Indiana Gasoline Use Tax Guide

- Indiana Sales Tax Guide for Entertainment Products

- Indiana Sales Tax Guide for Insurance

- Indiana Sales Tax Guide for Nursing Homes

- Indiana Sales Tax Guide for Telecommunications

- Indiana Sales Tax Guide for Wholesalers

- Indiana Sales Tax Guide for the Sales of Utilities Used in Manufacturing

- Indiana Sales Tax Guide for Drop Shipments

- Indiana Sales Tax Guide for Construction Contractors

- Indiana Sales Tax Guide for Aircraft Maintenance / A&P’s / FAA Repair Stations

- Indiana Sales Tax Guide for Flight Schools, Flight Instruction, Aircraft Leasing

- Indiana Sales Tax Guide for Delivery and Installation Charges

Determining Local Sales and Use Tax Rates in Indiana

Indiana’s base or statewide sales tax rate is 7.00%. Indiana does not have additional taxing jurisdictions, so there are no local sales and use taxes to worry about when selling into IN. How nice!

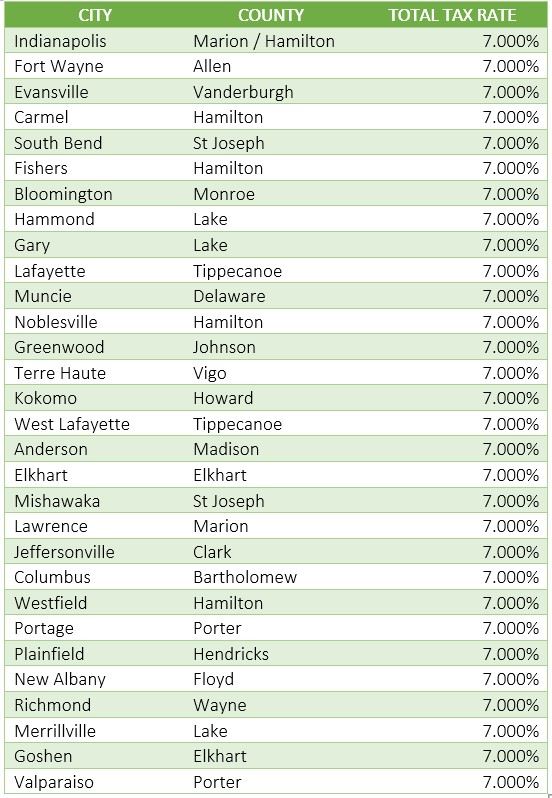

List of Local Sales and Use Tax Rates in Indiana

The Indiana sales and use tax rate for the largest 30 cities are listed below.

I Should Have Collected Indiana Sales Tax, But I Didn’t

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement (VDA) in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Indiana sales tax, the primary options are to:

- Register and pay back taxes, penalties, and interest, or

- Complete a VDA to eliminate penalties (and in some cases reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Indiana and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If you’re unsure what your past liabilities are, contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Option 2: Voluntary Disclosure Agreement (VDA)

Indiana’s lookback period: 3 years plus current period.

In many situations, voluntary disclosures are a useful tool to reduce extended periods of past exposure. For example, if you should have been collecting sales tax for 10 years, the voluntary disclosure limits the lookback period to 3 years. As a result, the benefit of doing a VDA often turns on:

- Whether the VDA limits lookback period. i.e. – you established nexus more than 3 or 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

I Received an Indiana Sales and Use Tax Audit Notice, What Should I Do?

Indiana regularly audits businesses that are required to charge, collect, and remit various taxes in the state. Businesses that receive a sales and use tax audit notice should consider the following:

- Unless you have experience handling Indiana sales and use tax audits, how can you trust that the state’s auditor is abiding by the rules and following proper procedure?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to the limiting exposure and shaping the results. Are you confident in doing that on your own?

If you are unsure of the answer to these questions and you do not have experience handling Indiana sales tax audits, hiring a professional might be right for you. Contact us and learn how our sales tax professionals can give you the peace-of-mind and confidence you need during your audit.

Please visit our resource pages for more detailed information and to help you evaluate critical decisions during your Indiana sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

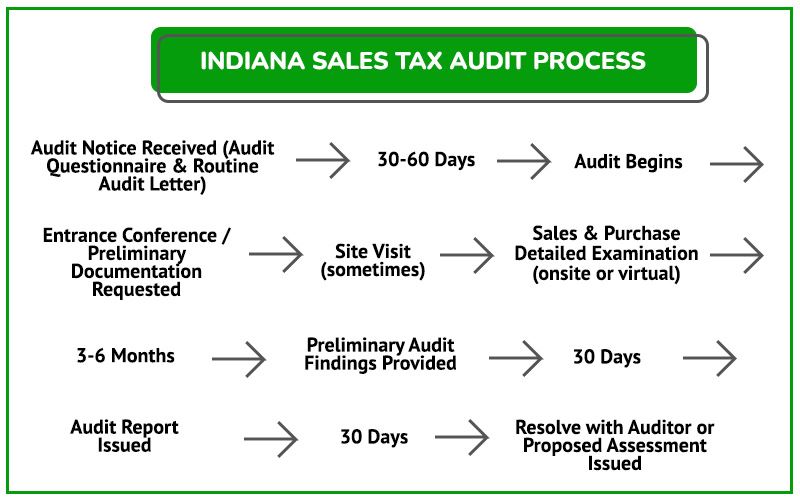

Indiana Sales Tax Audit Process

The audit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive a Indiana Sales and Use Tax Audit Notice (Indiana Routine Audit Letter)

Many audits begin with a call out of the blue from an Indiana Department of Revenue’s sales tax auditor. Shortly after the call, your business will receive an audit notice which confirms that you were lucky enough to be chosen for an Indiana sales and use tax audit. To prepare for the audit, it is likely a good idea to start by getting a state and local tax professional involved.

What to Expect From A Indiana Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested (many of which the auditor is not entitled to and does not need).

What to Expect During The Audit

- Once the necessary records are received, the auditor will:

- Conduct the audit by comparing your Indiana sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Indiana sales tax return(s).

- NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

- Once the auditor is confident all sales are accounted for, they will review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request a detail of certain documents / accounts to make sure use tax was properly paid on applicable purchases. Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

- Conduct the audit by comparing your Indiana sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Indiana sales tax return(s).

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to Indiana. This often leads to shocking results for the unsuspecting taxpayer during an audit.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding workpapers to support the Indiana sales and use tax assessment. It is advisable to have a sales tax professional present during this meeting as this is your first opportunity to see the auditor’s findings and push back on areas where they have overstepped their bounds or misapplied Indiana’ sales tax laws.

We recommend businesses refrain from agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged. Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel were not well versed in the sales tax laws that, if challenged, could have reduced their Indiana sales tax liability.

The process of challenging an Indiana sales tax audit assessment is discussed in detail in the following sections.

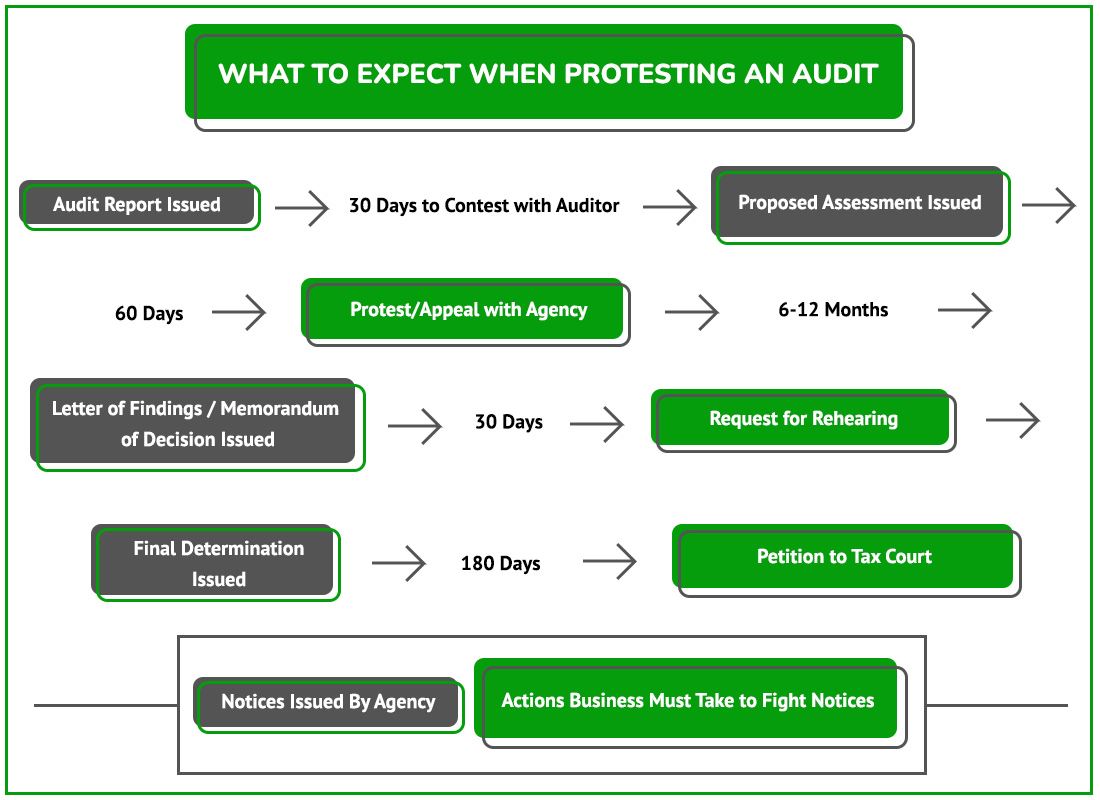

Indiana Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadlines is also missed, it can be very difficult to get case reopened.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue an Indiana Notification of Proposed Assessment (AKA the audit report). This document details the auditor’s findings so it’s important to carefully review and understand its implications. Any issues with the results are handled as follows:

- Auditee has 60 days to contest findings with the auditor.

- Documentational issues (exemption certificates, proof tax was paid, etc.) and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

- If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the Indiana Department of Revenue.

Appeal / Protest with the Indiana Department of Revenue

Any contested issues that were unresolved prior to the audit report being issued can be protested / appealed by the auditee. This is done after the Indiana Department of Revenue issues the Notification of Proposed Assessment.

- A protest / appeal must be done within 60 days of the Proposed Assessment.

- If you miss the 60 days, in some cases you have may have additional time to pay the tax and file a refund claim.

- If both periods are missed, the assessment becomes final, and it is very difficult to reopen the audit.

If you have received a Notification of Proposed Assessment and have not at least talked to someone experienced in Indiana State and Local tax, now is the time before these deadlines are missed.

Letter of Findings / Memorandum of Decision

If you cannot resolve the Indiana sales and use tax dispute through the protest / appeal process, the Indiana Department of Revenue will issue Letter of Findings or Memorandum of Decision. The LOF or MOD gives you the opportunity to re-protest the assessment within the agency or file in Indiana’s tax / administrative court, which is called the Indiana Tax Court. There are important deadlines in this phase of the process as well, such as 180 days to file in administrative court.

Settling an Indiana Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Indiana sales tax case by negotiating with the Indiana Department of Revenue. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Indiana state and local tax lawyer or other professional.

Contest an Indiana Jeopardy Assessment

Indiana may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Indiana Department of Revenue accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Indiana Administrative Court

If you cannot resolve the case within the agency or missed your deadlines, you still have one last shot to fight your Indiana sales tax assessment by going to the Tax Court. Although we generally don’t recommend it, you always have the option to skip the agency protest process and file in administrative court. That said, because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

Other Indiana Sales Tax Resources

Reviews

-

"Jerry Provided Calming, Clear Guidance"

I can't say enough about Jerry and STH. We were in a bit of a panic re reaching nexus levels and dealing with reseller tax ...

- Mike L. -

"My Entire Experience Was Superior"

My entire experience from intake to resolution with Sales Tax Helper was superior. '11' on a scale of 1-10! Initial meeting ...

- Tim N. -

"Prompt, Courteous & Helpful!"

I sincerely am grateful for the prompt, courteous, and helpful that has been offered me by Sales Tax Helper. My agent, Alex ...

- Carol M. -

"Professional and Very Communicative"

When my business needed guidance with sales and use tax, I reached out to Sales Tax Helper through their website and received ...

- Pierce L. -

"They Are Experts in Their Field"

Jerry & Alex are excellent at what they do. They helped me navigate some very difficult and stressful situations. They’re ...

- Greg M. -

"Excellent Team to Work With!"

The team at Sales Tax Helper was excellent to work with. I had a complex business sales tax challenge that they methodically ...

- Mike M. -

"Always Provide Accurate & Prompt Responses"

Alex and Jerry always provide very accurate and prompt responses to my inquiries regarding the sales tax. They also bring ...

- Lukas P. -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O.