Illinois Sales and Use Tax & Audit Guide

This guide is for businesses that need straightforward answers on the following Illinois Sales and Use Tax subjects:

- Do I need to be collecting Illinois sales tax?

- Should I be collecting or paying Illinois use tax?

- What do I do if I should have been collecting Illinois sales and use tax but haven’t?

- I received an audit notice from the Illinois Department of Revenue, what should I do?

- Guidance on fighting a sales tax assessment in Illinois.

Who Needs to Collect Illinois Sales and Use Tax?

Like most states, to be subject to Illinois sales tax collection and its rules, your business must:

1) have nexus with Illinois, and

2) sell or use something that is subject to Illinois sales tax.

How Is Nexus Established in Illinois?

According to the Illinois Department of Revenue (IDOR), sales tax nexus is created in Illinois if a business has a physical presence in Illinois, such as:

- Having employees, agents, or independent contractors for the purposes of taking orders, making sales or deliveries, or installing or assembling tangible personal property in Illinois.

- Maintaining an office, warehouse, or other place of business in Illinois.

- Assembling, installing, servicing, or repairing products in Illinois.

- Having a 3rd party affiliate within Illinois

- Owning, renting, or leasing real property or tangible personal property in Illinois, including a computer server in Illinois.

- Delivering goods to Illinois customers using your company-owned or leased truck.

- Maintaining inventory in Illinois using a third-party fulfillment service, such as Fulfilled by Amazon (“FBA”).

NOTE: Not only does a company doing business in Illinois have to worry about the Illinois Department of Revenue, but local revenue agencies such as the Chicago Department of Revenue and the Cook County Department of Revenue also regularly and aggressively audit business for sales and use and other local taxes.

Additionally, business that do not have a physical presence in Illinois, can establish economic nexus by exceeding a certain annual sales threshold in the state. See the next section for details.

Economic Nexus (Wayfair Law) And Internet Sales in Illinois

As of October 1, 2018, businesses located outside of Illinois may also be subject to its sales and use tax laws. Specifically, Illinois’s Wayfair law requires that a purely out of state business register with IDOR to collect and remit sales and use tax if the business has sales of tangible personal property delivered into Illinois exceeding $100,000 or 200 transactions during the preceding or current calendar year.

Which Sales Are Subject to Illinois Sales Tax?

General Transactions

If you have nexus in Illinois, the next step is to determine whether the products or services you sell are subject to Illinois sales and use tax. Like most states, unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Illinois sales tax.

While the general rules seem straightforward, the application of Illinois sales tax rules and their nuances, complexities, and application to your business can get complicated. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common exemptions from Illinois sales and use tax:

- Groceries, including candy, confectionary, and snack foods

- Medicines

- Newspapers & magazines

- Prescription medicines

- Many items used in farming or manufacturing.

Services

Generally, services are not subject to sales tax in Illinois.

Software

Illinois generally taxes software and SaaS regardless of the form which it is transmitted or delivered. However, custom software is not subject to sales and use tax.

Shipping & Handling

Illinois has traditional rules with respect to the taxability of shipping and handling charges. If the shipping charge is separately stated and at the option of the customer, the shipping and handling charge is not taxable. Otherwise, the charge is subject to sales tax.

Industry-Specific Guides for Illinois Sales and Use Tax

While the general sales tax rules seem straightforward, the application of those rules can get tricky when gray areas come up, and they inevitably do. These guides were developed by Illinois to provide some industry specific guidance on the application of Illinois sales and use tax.

- Illinois Use Tax Guide for Aircraft

- Illinois Sales Tax Guide for Aircraft and Boat Sales

- Illinois Sales Tax Guide for Aircraft Repair Stations

- Illinois Use Tax Guide for Boats

- Illinois Sales Tax Guide for Remote Sellers

- Illinois Sales Tax Guide for Rental Car Businesses

- Illinois Sales Tax Guide for Business District Retailers' Occupation Tax

- Illinois Sales Tax Guide for Retail Sales of Soft Drinks in Chicago

- Guide to DuPage, Kane, and McHenry, and Will Counties Sales Tax on Motor Fuel

- Illinois Motor Fuel Tax Rates for 2021

- Illinois Sales Tax Guide for Home Rule and Non-home Rule Sales & Use Taxes

- Illinois Sales Tax Guide for Prepaid Wireless Telecommunications Service

- Illinois Sales Tax Guide for Live Adult Entertainment

- Illinois Sales Tax Guide for Metro-East Mass Transit District (MED) Sales Tax

- Illinois Sales Tax Guide for Metro-East Park and Recreation District Sales Tax

- Illinois Sales Tax Guide for Metropolitan Pier and Exposition Authority (MPEA) Food and Beverage Tax

- Illinois Sales and Use Tax Guide for Tire Sales

Determining Local Sales and Use Tax Rates in Illinois

The base or statewide sales tax rate in Illinois is 6.25%. However, other taxing authorities, like counties, cities, transit authorities, etc., can impose additional sales taxes. This can make it difficult to determine how much tax to apply to a given sale, especially for out-of-state or remote sellers. Sine Illinois is an origin-based sales tax state, locally based businesses only need to charge the sales taxes applicable to their location. Out-of-state businesses, however, are required to charge sales tax applicable to the delivery location of each sale.

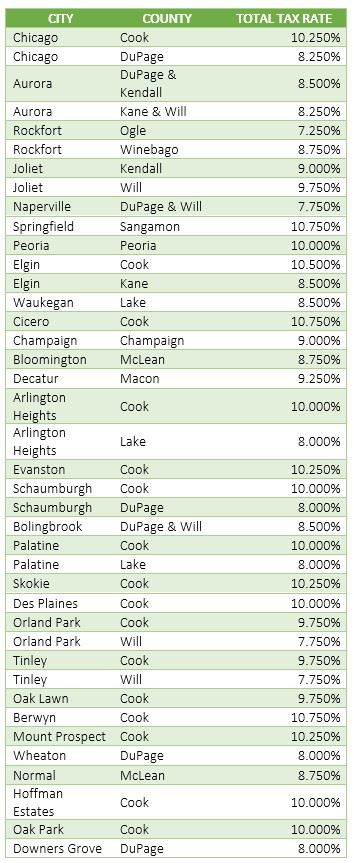

List of Local Sales and Use Tax Rates in Illinois

The combined Illinois + general merchandise home rule sales and use tax rates for the largest 30 cities as of January 2021 are listed below. Additional sales tax rates can be found here.

I Should Have Collected Illinois Sales Tax, But I Didn’t

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement (VDA) in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Illinois sales tax, the primary options are to:

- Register and pay back taxes, penalties, and interest, or

- Enter into a VDA to eliminate penalties (and in some cases reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Illinois and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If you’re unsure what your past liabilities are, contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Option 2: Voluntary Disclosure Agreement (VDA)

Illinois VDA lookback period: 4 years

In many situations, voluntary disclosures are a useful tool to reduce extended periods of past exposure. For example, if you should have been collecting sales tax for 10 years, the voluntary disclosure limits the lookback period to 4 years. As a result, the benefit of doing a VDA often turns on:

- Whether the VDA limits lookback period. i.e. – you established nexus more than 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

I Received an Illinois Sales and Use Tax Audit Notice, What Should I Do?

Illinois regularly audits businesses that are required to charge, collect, and remit various taxes in the state. Businesses that receive a sales and use tax audit notice should consider the following:

- Unless you have experience handling Illinois sales and use tax audits, how can you trust that the state’s auditor is abiding by the rules and following proper procedure?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to the limiting exposure and shaping the results. Are you confident in doing that on your own?

If you are unsure of the answer to these questions and you do not have experience handling Illinois sales tax audits, hiring a professional might be right for you. Contact us and learn how our sales tax professionals can give you the peace-of-mind and confidence you need during your audit.

Additionally, these resource pages are full of detailed information to help you evaluate critical decisions during your Illinois sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

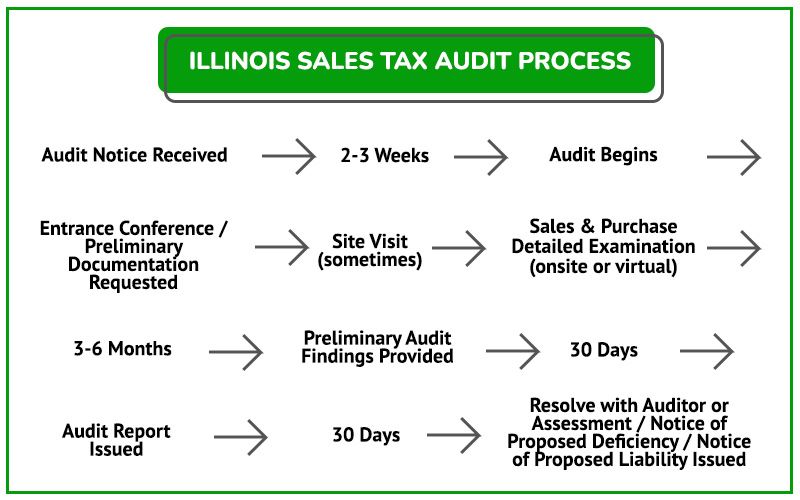

Illinois Sales Tax Audit Process

Illinois sales and use tax audits usually follow the process laid out in the following flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive an Illinois Sales and Use Tax Audit Notice

Many audits begin with an unexpected call from an IDOR sales tax auditor. Shortly after the call, your business will receive an audit notice confirming that your business was selected for a (field or desk) Illinois sales and use tax audit. Lucky you!! But before you celebrate too much, it’s a good idea to prepare for the audit. We highly recommend you start by getting a state and local tax professional involved.

What to Expect from An Illinois Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested (many of which the auditor is not entitled to and does not need).

- Usually, the auditor will tell you that, as part of the audit, they are looking for any areas where your business is entitled to a sales tax refund. While it is technically their job to look for this, they very seldom (if ever) do.

What to Expect During the Audit

- Once the necessary records are received, the auditor will:

- Conduct the sales tax audit by comparing your Illinois sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Illinois sales tax return(s).

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

- Once the auditor is confident all sales are accounted for, they will review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request a detail of certain documents / accounts to make sure use tax was properly paid on applicable purchases. Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to Illinois. This often leads to shocking results for the unsuspecting taxpayer during an audit.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding workpapers to support the Illinois sales and use tax assessment. It is advisable to have a sales tax professional present during this meeting as this is your first opportunity to see the auditor’s findings and push back on areas where they have overstepped their bounds or misapplied Illinois’ sales tax laws.

We recommend businesses refrain from agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged. Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel were not well versed in the sales tax laws that, if challenged, could have reduced their Illinois sales tax liability.

The process of challenging an Illinois sales tax audit assessment is discussed in detail in the following sections.

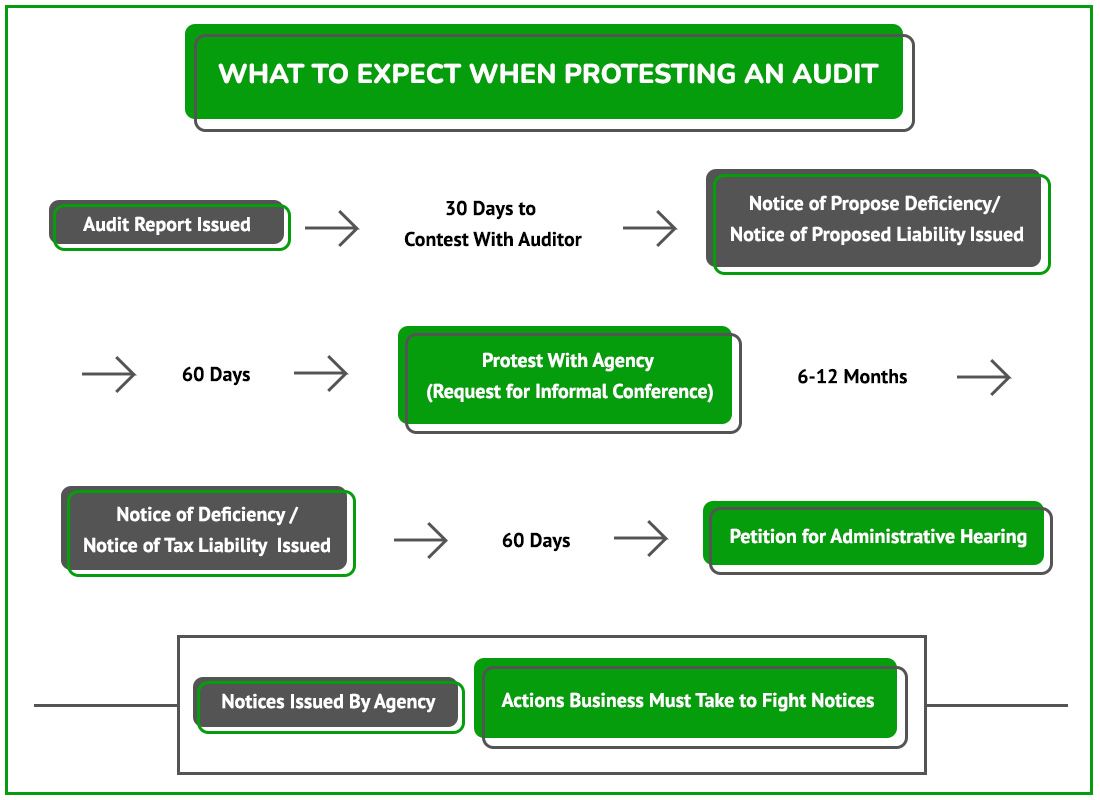

Illinois Sales Tax Audit Protest Flow Chart

NOTE: In Illinois you have the option to forego the administrative hearing process and seek review by filing a petition with the Independent Tax Tribunal. Further, if you feel you have been treated unfairly you can appeal to the Board of Appeals after a decision has been rendered by an administrative hearing or tax tribunal decision.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue an Illinois Audit Report. This document details the auditor’s findings so it’s important to carefully review and understand its implications. Any issues with the results are handled as follows:

- Auditee has 30 days to contest findings with the auditor.

- Documentational issues (exemption certificates, proof tax was paid, etc.) and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

- If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the Illinois Department of Revenue.

Appeal / Protest with the Illinois Department of Revenue

Any contested issues that were unresolved prior to the audit report being issued can be protested / appealed by the auditee. This is done after the Illinois Department of Revenue issues the Notice or Proposed Deficiency / Notice of Proposed Liability.

- A protest / appeal must be done within 30 or 60 days of the Notice of Proposed Deficiency / Liability issuance.

If you have received a Notice of Proposed Deficiency / Liability and have not at least talked to someone experienced in Illinois State and Local tax, now is the time before these deadlines are missed.

Settling an Illinois Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Illinois sales tax case by negotiating with IDOR. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Illinois state and local tax lawyer or other professional.

Contest an Illinois Jeopardy Assessment

Illinois may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives IDOR accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has a short period of time to contest the assessment and must place a security deposit to fight the issue.

Illinois Administrative Court / Tax Tribunal

If you cannot get your audit resolved within the agency or your deadlines have been missed, you still have one last shot to fight your Illinois sales tax assessment by filing for an Illinois Administrative Hearing. Likewise, and generally not recommended, along the way you always have the option to skip the agency protest and file in administrative court. That said, because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

If your case is filed in administrative court, and the case proceeds to hearing, it is heard and decided by a neutral panel of administrative law judges. Our team has handled hundreds of administrative court cases and can help your company receive the resolution it is entitled to. It is very similar to a court hearing and having an experienced representative is imperative.

Alternatively, a taxpayer can seek review by filing with the Independent Tax Tribunal. The Tax Tribunal is an independent agency designed to resolve disputes between taxpayers and the IDOR. At the conclusion, the Tax Tribunal issues a final judgment order resolving the dispute.

Other Illinois Sales Tax Resources

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.