Florida Sales and Use Tax & Audit Guide

This guide is for businesses that need straightforward answers on the following Florida Sales and Use Tax subjects:

- Do I need to be collecting Florida sales tax?

- Should I be collecting or paying Florida use tax?

- What do I do if I should have been collecting but haven’t?

- I received an audit notice, what should I do?

- Guidance on fighting a sales tax assessment in Florida.

Who Needs to Collect Florida Sales and Use Tax?

Like most states, to be subject to Florida sales tax collection and its rules, your business must:

1) have nexus with Florida, and

2) sell or use something that is subject to Florida sales tax.

Nexus – How Is It Established in Florida?

Florida is one of the few states that has not enacted an economic nexus sales threshold (Wayfair law) for out of state businesses making remote or internet sales in Florida. As a result, out of state businesses only need to worry about Florida sales and use tax if they have sales tax nexus with Florida. According to the Florida Department of Revenue, sales tax nexus is created in Florida if a business has a physical presence in Florida, such as:

- Having employees, agents, or independent contractors conducting sales or other business activities in Florida.

- Maintaining an office or other place of business in Florida.

- Assembling, installing, servicing, or repairing products in Florida.

- Owning, renting, or leasing real property or tangible personal property in Florida.

- Delivering goods to Florida customers using your company-owned or leased truck.

Which Sales Are Subject to Florida Sales Tax?

General Transactions

If you have nexus in Florida, the next step is to determine whether the products or services you sell are subject to Florida sales and use tax. Like most states, unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Florida sales tax.

While the general rules seem straightforward, the application of Florida’s sales tax rules and their nuances, complexities, and application to your business can get complicated. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common exemptions from Florida sales and use tax:

- Groceries

- Medicines

- Common household remedies

- Many items used in farming or manufacturing.

Although there are some exemptions for long term residential real property leases, Florida imposes its sales and use tax on real property rentals, even if the rental is between related parties. This often comes as a surprise for the unsuspecting tax professional as Florida is the only state in the country that imposes its sales tax on such transactions.

Services

Generally, services are not subject to sales tax in Florida. However, there a few services that are specifically subject to sales tax, such as:

- Investigative and Crime protection services

- Nonresidential cleaning

- Nonresidential pest control services

Software

Florida does not tax software or SaaS unless the software is delivered on a tangible medium.

Shipping & Handling

Florida has traditional rules on shipping and handling charges. So long as the shipping & handling is separately stated and at the customer’s option, it is not subject to Florida sales tax.

Specific Industries

While the general sales tax rules seem straightforward, the application of those rules can get tricky when gray areas come up. These guides were developed by Florida to provide some industry specific guidance.

- Aircraft Dealers

- Aircraft Owners

- Alcoholic Beverages

- Amusement Machines

- Boat Dealers and Brokers

- Boat Owners

- Cleaning Services

- Commercial Real Property Rentals

- Concession Stands

- Construction

- Detective and Burglar Protection

- Drycleaners

- Extermination Services

- Interior Decorators and Interior Designers

- Mobile and Manufactured Home Repair

- Taxation of Mobile Homes

- Tax Information for Motor Vehicle Dealers

- Rental Car Surcharge, New Tire Fee, and Lead-Acid Battery Fee

- Parking Lots, Boat Docks and Aircraft Hangers

- Repair Services

- Rental of Living or Sleeping Accommodations

- Restaurants and Catering

- Secondhand Goods and Secondary Metals

- Tangible Personal Property Rentals

- Trade Show and Convention Exhibitors

- Vending Machines

- Veterinarians

Determining Local Sales and Use Tax Rates in Florida

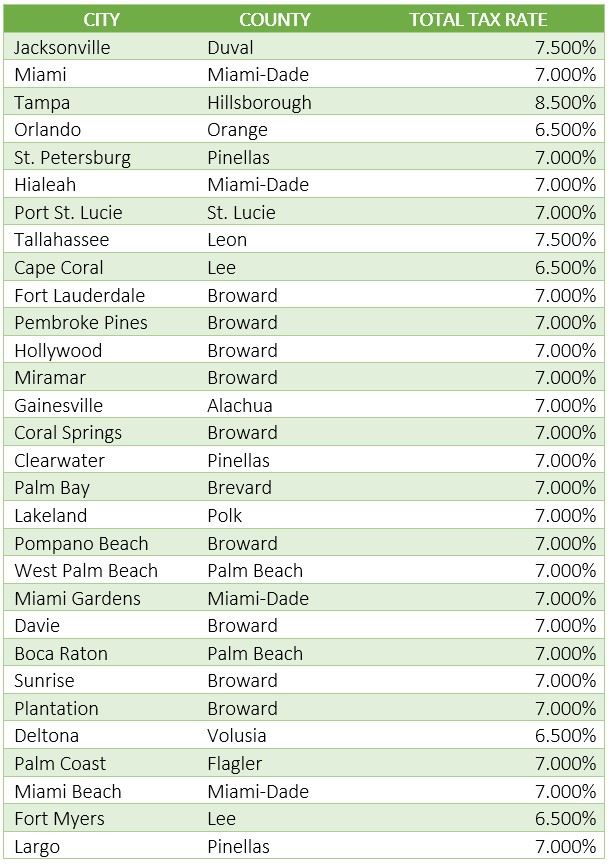

Florida’s general sales tax rate is 6%. However, counties can charge a local surtax on top of the 6%. The County surtax applies if the sale is made within or delivered to a location within the respective county. County surtaxes are remitted to the state as part of the Florida sales and use tax return.

List of Local Sales and Use Tax Rates in Florida

The combined Florida state + local sales and use tax rates for the largest 30 cities are listed below. A comprehensive list can be found here.

I Should Have Collected Florida Sales Tax, but I Didn’t

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement (VDA) in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Florida sales tax, the primary options are to:

- Register and pay back taxes, penalties, and interest, or

- Enter into a VDA to eliminate penalties (and in some cases reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Florida and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be weary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If you’re unsure what your past liabilities are, contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Option 2: Voluntary Disclosure Agreement (VDA)

Florida’s VDA lookback period: 3 years.

In many situations, voluntary disclosures are a useful tool to reduce extended periods of past exposure. For example, if you should have been collecting sales tax for 10 years, the voluntary disclosure limits the lookback period to 3-4 years. As a result, the benefit of doing a VDA often turns on:

- Whether the VDA limits lookback period. i.e. – you established nexus more than 3 or 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

I Received a Florida Sales and Use Tax Audit Notice, What Should I Do?

Florida regularly audits businesses that are required to charge, collect, and remit various taxes in the state. Businesses that receive a sales and use tax audit notice should consider the following:

- Unless you have experience handling Florida sales and use tax audits, how can you trust that the state’s auditor is abiding by the rules and following proper procedure?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to the limiting exposure and shaping the results. Are you confident in doing that on your own?

If you are unsure of the answer to these questions and you do not have experience handling Florida sales tax audits, hiring a professional might be right for you. Please contact us for any questions.

Please visit our resource pages for more detailed information and to help you evaluate critical decisions during your Florida sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

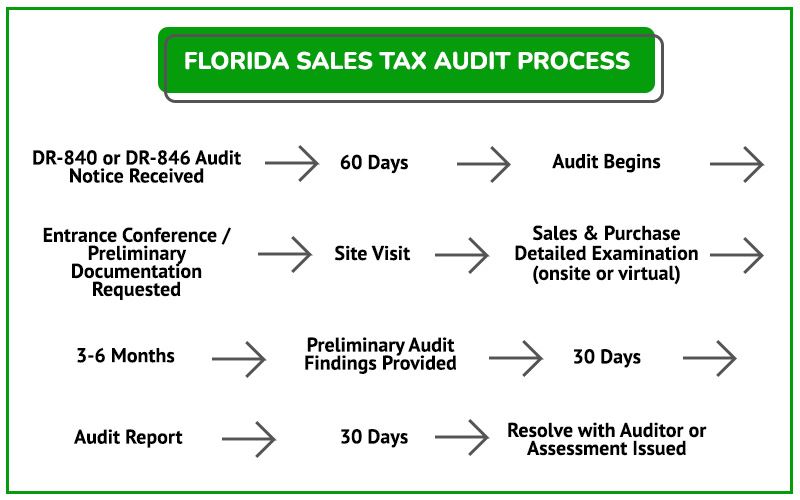

Florida Sales Tax Audit Process

The audit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive a Florida Sales and Use Tax Audit Notice (DR-840 or DR-846)

Many audits begin with a call out of the blue from a Florida Department of Revenue sales tax auditor. Shortly after the call, your business will receive an audit notice, Form DR-840 (field audit) or DR-846 (Desk Audit), which confirms that you were lucky enough to be chosen for a Florida sales and use tax audit. To prepare for the audit, it is likely a good idea to start by getting a state and local tax professional involved.

What to Expect From A Florida Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested (many of which the auditor is not entitled to and does not need).

What to Expect During The Audit

Once the necessary records are received, the auditor will:

- Conduct the audit by comparing your Florida sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Florida sales tax return(s).

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

- Once the auditor is confident all sales are accounted for, they will review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request a detail of certain documents / accounts to make sure use tax was properly paid on applicable purchases. Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to Florida. This often leads to shocking results for the unsuspecting taxpayer during an audit.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding workpapers to support the Florida sales and use tax assessment. It is advisable to have a sales tax professional present during this meeting.

Eventually the audit will culminate in a final audit report. The purpose of the Florida sales tax audit report is to provide a clear basis of the assessment. While it may be cause for panic or concern, the receipt of the audit report can actually help the taxpayer by illuminating the road map to resolve the case.

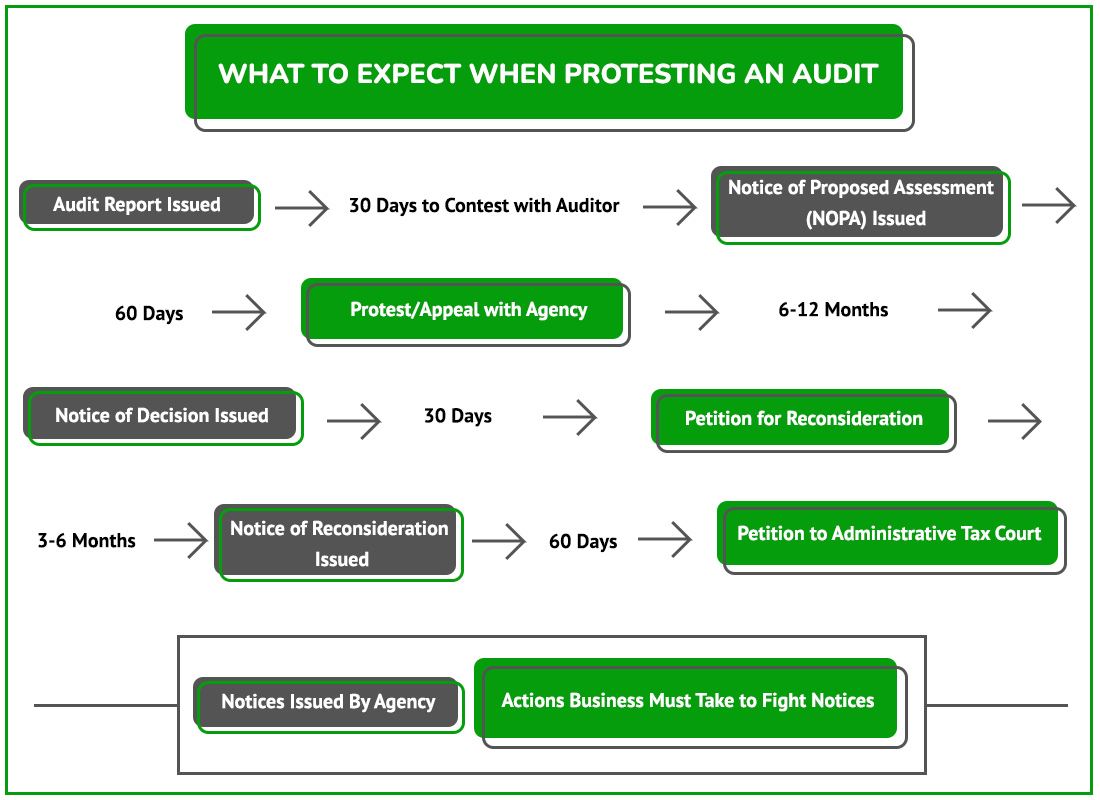

Following the audit, if you disagree with the adjustments and cannot reach a resolution with the auditor, the assessment is finalized and issued. The business or its state and local tax professional can file an appeal (called a protest), with the Florida Department of Revenue.

NOTE: If NOPA or NOD deadline is missed, you have an additional 60 days to file in administrative court. If that deadlines is also missed, it can be very difficult to get case reopened.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue a Florida Notice of Intent to Make Audit Changes (AKA the audit report). This document details the auditor’s findings so it’s important to carefully review and understand its implications. Any issues with the results are handled as follows:

- Auditee has 30 days to contest findings with the auditor.

- Documentational issues (exemption certificates, proof tax was paid, etc.) and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

- If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the Florida Department of Revenue.

Appeal / Protest Unresolved Disputes

Any contested issues that were unresolved prior to the audit report being issued can be protested / appealed by the auditee. This is done after the Florida Department of Revenue issues the Notice of Proposed Assessment.

- A protest / appeal must be done within 60 days of the Notice Proposed Assessment (NOPA) issuance.

- If you miss the 60 days, you have an additional 60 days to file in administrative or Circuit Court to challenge the audit findings.

- If both periods are missed, the assessment becomes final and it is very difficult to reopen the audit.

If you have received a Notice of Proposed Assessment and have not at least talked to someone experienced in Florida State and Local tax, now is the time before these deadlines are missed.

Notice of Decision

If you cannot resolve the Florida sales and use tax dispute through the protest / appeal process, the Florida Department of Revenue will issue a Notice of Decision (NOD). The Notice of Decision gives you the opportunity to re-protest the assessment within the agency or file in Florida’s tax / administrative court, which is called the Florida Division of Administrative Hearings. There are important deadlines, such as 30 days to re-protest or 60 days to file in administrative court.

Settling a Florida Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Florida sales tax case by negotiating with the Florida Department of Revenue. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Florida state and local tax lawyer or other professional.

Contest a Florida Jeopardy Assessment

Florida may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Florida Department of Revenue accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has 21 days to contest the assessment and must place a security deposit to fight the issue.

Florida Administrative Court

If the NOPA or NOD deadlines are missed, you still have one last shot to fight your Florida sales tax assessment by going to Florida administrative court. Likewise, and generally not recommended, along the way you always have the option to skip the agency protest and file in administrative court. That said, because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

If your case is filed in administrative court, and the case proceeds to hearing, it is heard and decided by a neutral administrative law judge. Our team has handled hundreds of administrative court cases and can help your company receive the resolution it is entitled to. It is very similar to a court hearing and having an experienced representative is imperative.

Other Florida Sales Tax Resources

Reviews

-

"Jerry Provided Calming, Clear Guidance"

I can't say enough about Jerry and STH. We were in a bit of a panic re reaching nexus levels and dealing with reseller tax ...

- Mike L. -

"My Entire Experience Was Superior"

My entire experience from intake to resolution with Sales Tax Helper was superior. '11' on a scale of 1-10! Initial meeting ...

- Tim N. -

"Prompt, Courteous & Helpful!"

I sincerely am grateful for the prompt, courteous, and helpful that has been offered me by Sales Tax Helper. My agent, Alex ...

- Carol M. -

"Professional and Very Communicative"

When my business needed guidance with sales and use tax, I reached out to Sales Tax Helper through their website and received ...

- Pierce L. -

"They Are Experts in Their Field"

Jerry & Alex are excellent at what they do. They helped me navigate some very difficult and stressful situations. They’re ...

- Greg M. -

"Excellent Team to Work With!"

The team at Sales Tax Helper was excellent to work with. I had a complex business sales tax challenge that they methodically ...

- Mike M. -

"Always Provide Accurate & Prompt Responses"

Alex and Jerry always provide very accurate and prompt responses to my inquiries regarding the sales tax. They also bring ...

- Lukas P. -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O.