Alabama Sales and Use Tax & Audit Guide

This guide is for businesses that need clarity on common Alabama Sales and Use Tax issues, including:

- When should I collect and remit Alabama sales or use tax?

- What happens if I should have collected Alabama sales tax but didn’t?

- What can I do after receiving an audit notice from the Alabama Department of Revenue?

- How to defend against a sales tax assessment in Alabama.

Who Needs to Collect Alabama Sales and Use Tax?

Alabama sales tax applies to business owners, retailers, and other sellers of personal property that has nexus with the state. Tax can also apply to consumers who use property in Alabama.

How Do I Know If I Have Nexus in Alabama for Paying Sales Tax?

The Alabama Department of Revenue (ADOR) typically determines a business to have nexus if it has a physical presence in Alabama, such as through any of the following activities:

- You occupy a physical commercial space such as an office, storefront, distribution center, warehouse, etc.

- You have sales reps, employees, or agents who conduct business in Alabama (e.g., sell, deliver, or take order for taxable items).

- You assemble, install, service, or repair products in Alabama.

- You own or rent real property or tangible personal property in Alabama, including computer servers or software that solicits orders for taxable items.

- You have inventory in Alabama, including through use of a third-party fulfillment service (e.g., Fulfilled by Amazon (“FBA”)).

Additionally, online businesses without a physical presence in Alabama, can still have economic nexus based on their annual sales. See the next section for more details.

Expanded Nexus for Internet Sales in Alabama After Wayfair

Effective October 1, 2018, an out of state business (a.k.a. a remote seller) or marketplace facilitator must register with the ADOR to collect and remit sales and use taxes if the business had annual sales in Alabama totaling more than $250,000 in the prior calendar year. This threshold generally excludes wholesale transactions intended for resale and sales that occur through a SSUT-registered marketplace facilitator. Qualifying businesses will register through the Alabama Simplified Sellers Use Tax Program (SSUT).

NOTE: As of November 1, 2020, businesses will need to renew their seller licenses annually. Login to your ADOR account here to renew.

Alabama Sales Made Through Marketplace Providers

If your business sells on Amazon or a similar marketplace provider, you may not be responsible for collecting the related sales tax. Specifically, if the marketplace provider certifies they are collecting and reporting sales tax, you are usually off the hook.

However, such sales could count towards your total sales threshold, potentially requiring your business to collect tax on sales made directly through your website or other marketplaces in the future. As of 2018, Alabama views the facilitator that makes sales into Alabama of more than $250,000 in a year as the seller, making it responsible for collecting the sales tax.

Examples of Common Sales That Are Subject to Alabama Sales Tax

General Transactions

If you make sales of tangible personal property or taxable services, the general rule is that Alabama sales tax will apply unless an exemption or another exception exists. Some common exemptions that may apply to your business sales in Alabama could include:

- Raw materials used in manufacturing

- Pollution control equipment

- Quality control testing

- Sales from a qualifying business in an Enterprise Zone

- Sales to qualifying exempt organizations (e.g., certain government entities or charities)

- Prescription drugs

- Livestock feed

- Sales paid with food stamps

While the general rule on sales tax seems straightforward, its application can lead to a variety of outcomes when considering the nuances of Alabama’s sales tax rules and regulations. When questions on taxability arise, we recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Services

Generally, services are not subject to Alabama sales tax, even when made in conjunction with the sale of tangible personal property, so long as separately stated on the invoice. For example, gross proceeds from a photographer’s services like sitting or consultation fees are exempt from tax despite the fact the photographer likely provides prints and other taxable items.

Software

Alabama broadly subjects software and SaaS to state sales tax, including licensing fees for its use. Services related to the sale of software, like upgrades and other maintenances, can also be taxable depending on the circumstance. Custom software, however, is generally not subject to tax.

Shipping & Handling

Alabama’s rule on the taxability of shipping & handling is that deliveries made by the seller are subject to tax on transportation charges. Deliveries made by a common carrier, or the U.S. Postal Service are not subject to tax if the transportation charges are separately stated on the invoice, paid by the purchaser, and are identifiable from other charges (e.g., “shipping and handling” or “postage and handling charges”). See Alabama Regulation 810-6-3-.65.

Drop Shipments

Alabama acknowledges two separate transactions that occur for sales fulfilled through a drop-shipping method:

- The transaction between the drop-shipper and the reseller.

- The transaction between the reseller and the Alabama consumer.

If the reseller is selling to a customer in Alabama, the drop shipper can accept an Alabama resale certificate, to exempt the first transaction. This makes the second transaction taxable, and the reseller is the one who collects and remits the sales tax.

Determining Local Sales and Use Tax Rates in Alabama

Alabama’s general base sales tax rate is 4.00%. However, cities, counties, and other local jurisdictions can charge a surtax up to 7.00% on top of the 4.00% general rate. This can increase the total sales tax that you must be collect depending on the location of the sale or delivery.

The ADOR primarily remits any local surtax to the appropriate jurisdiction as part of the Alabama sales and use tax return although some taxing jurisdictions in Alabama may collect their own local taxes. The current Simplified Sellers Use Tax Rate is 8.00%.

Determining exactly how much tax to collect on a transaction can be overwhelming, but the basic process is:

- If a sale is taxable in Alabama, then the base tax rate of 4.00% must be charged as well as the local sales and use tax for the jurisdictions where you are engaged in business. Note: some products may have a different base rate (e.g., food or clothing)

- Generally, local surtaxes depend on the location of the seller’s place of business. Local use tax, in comparison, depends on the location where the customer receives the goods or services. If you ship or deliver goods to your customers from outside Alabama, you may have to collect local sales tax based on the customer’s location.

- In Alabama, each taxing authority has its own boundaries. Unfortunately, there is no logical way to determine which taxing jurisdiction a given sale is in, so we recommend using this tool by the ADOR that allows you to search for sales tax rates by address.

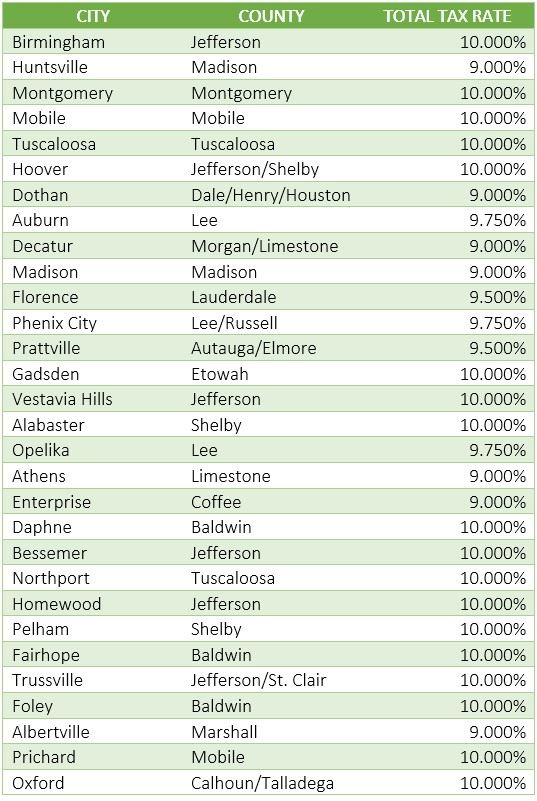

List of Local Sales and Use Tax Rates in Alabama

Below is the combined Alabama state + local sales and use tax rates for the largest 30 cities. A more comprehensive list can be found here.

What Happens If You Haven’t Been Collecting Alabama Sales Tax?

The answer depends on whether you are registered to pay Alabama sales tax and whether you have received notice from the ADOR about an audit or outstanding liability.

One option for retailers may be to voluntary disclose your sales tax liability and reach a settlement known as a voluntary disclosure agreement (VDA). However, the feasibility and value of this option will depend on your situation. Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a VDA, our sales tax professionals will work with you to determine a cost-effective solution for your business.

Two options generally exist for businesses that have nexus for paying Alabama sales tax but have not been collecting it from their customers:

- You could register and pay back taxes (including amounts for penalty or interest); or

- You could complete a VDA to eliminate penalties (and, in some cases, reduce your tax liability and avoid interest).

We consider the details of each option in the sections below:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes registering with the ADOR and paying owed tax will make more sense for your business compared to the VDA alternative. For example, a VDA may not be cost-effective if your past liabilities and penalties are minimal after considering the administrative costs of processing the VDA.

Be cautious of tax professional who recommend doing a VDA in these cases because their advice may not align with what makes economic sense for your company. If you’re unsure what your past liabilities are, contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When registration and payment may make more sense than the VDA:

- If your business has a nexus of less than 3 years.

- The sales tax penalty amount is less than the professional fees charged for a VDA.

- Your issues are not the result of uncollected sales tax.

Note: registering with the ADOR won’t usually eliminate past liabilities and interest.

Option 2: Voluntary Disclosure Agreement (VDA)

Alabama’s lookback period: 3 years.

The voluntary disclosure option, in comparison, is a more useful tool to reduce extended periods of past exposure. For example, if you should have been collecting sales tax for the last 10 years but haven’t, the voluntary disclosure limits the liability to the length of the lookback. This means the benefit of doing a VDA depends on:

- When you first established Nexus in Alabama.

- If the sales tax penalty savings is more than the professional fees charged for the VDA.

- Your sales tax issues stem from collecting but not remitting Alabama sales tax

What happens After I Receive an Alabama Sales and Use Tax Audit Notice?

The ADOR regularly audits businesses that have discrepancies in their sales tax returns or whose tax payments don’t align with the department’s expectations. Businesses that receive a sales and use tax audit notice may consider the following issues when contemplating available options:

- Your experience handling Alabama sales and use tax audits. Without prior knowledge, it can be tough to check for the accuracy of the state auditor’s findings and determinations.

- Your ability to know your options when asked to provide sensitive business or financial documents.

- Your knowledge of potential Alabama sales tax liability, if any.

If you are unsure on some of these points, hiring a professional might be right for you. Contact us and learn how our sales tax professionals can give you the confidence needed to effectively manage the sales tax audit process.

You can review our resource pages for more detailed information on the audit process and to help you further assess the needs of your business during an audit with the ADOR.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

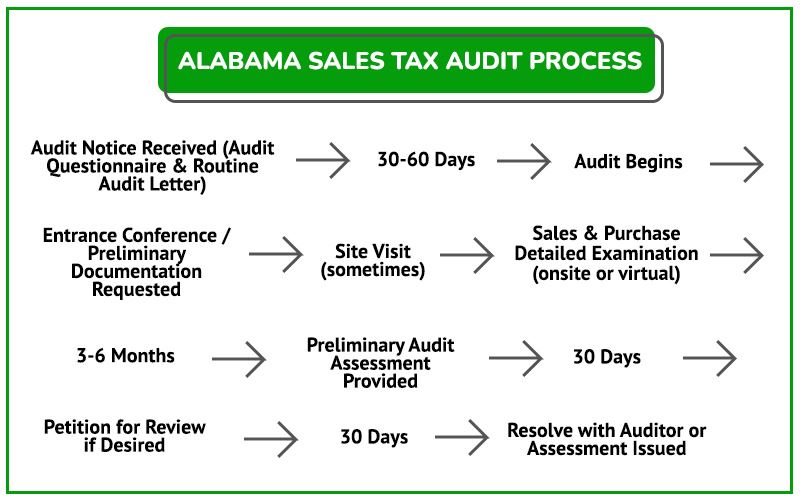

Alabama Sales Tax Audit Process

The audit process usually follows the steps in the flowchart below. See the detailed guidance for each stage to understand some of the administrative aspects of the process and the expected timeline between steps.

How Does an Alabama Sales and Use Tax Audit Start?

Many audits begin with a call from an ADOR sales tax auditor or other agent. Shortly after the call, your business will receive a notice confirming the audit. Once you receive that verbal or written notice of an audit, it may be time to consider meeting with a sales tax professional.

What the Alabama Sales Tax Auditor May Do After Sending the Audit Notice

- The auditor will conduct any pre-audit research.

- The auditor may schedule an entrance conference.

- The auditor will likely request documents (many of which may not be relevant or which you may not have to deliver depending on the circumstances).

What Happens During the Audit

- The auditor will analyze available records (e.g., SUT returns, federal income returns, bank statements, etc.).

NOTE: A slight error in how your business charged sales tax, on a single type of transaction, can add up to a considerable sales tax liability when multiplied over several years.

- Once the auditor can account for all sales during the audit period, they will review your exempt and out-of-state sales.

- Conduct a use tax audit on business expenses and other purchases like:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

Remember, if your business buys an item online without paying sales tax to the seller, your business still has an obligation to remit the use tax to Alabama. Failure to remember this obligation often leads to surprise liability notices for the taxpayers during an audit.

Defending Your Business’s Sales Tax Position After an Audit

One of the final audit steps is usually an exit conference with the auditor where they will produce an audit report with documentation to support the Alabama sales and use tax assessment. It is advisable to have a sales tax professional present during this meeting as this is your first opportunity to see the auditor’s findings and consider contesting areas where the auditor overstepped or misapplied Alabama’ sales tax laws.

We generally recommend that businesses refrain from agreeing to the sales tax assessment until a sales tax professional has reviewed the audit report for potential issues that could be worth challenging. The consequence can be drastic overpayment to the state because the business owner or in-house accounting personnel did not realize potential flaw in the assessment, that if challenged, could reduce Alabama sales tax liability.

The process of challenging an Alabama sales tax audit assessment is discussed in detail in the following sections.

Alabama Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be very difficult to get case reopened.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue an Alabama Preliminary Findings of Audit Results. This document details the auditor’s findings so it’s important to carefully review and understand what it says about your potential liability. Any issues with the results are handled as follows:

- Taxpayers have 30 days to contest the findings with the auditor.

- Documentation issues (e.g., use of exemption certificates, proof tax was paid, calculations, etc.) are worth protesting with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage and could require further appeal.

- If a resolution cannot be reached with the auditor, the next step is to appeal the issue with the Alabama Department of Revenue.

Final Assessment

If you cannot resolve the Alabama sales and use tax dispute through the protest and appeal process, the Alabama Department of Revenue will issue a Final Assessment. The Final Assessment Letter gives you the opportunity to re-protest the assessment with Alabama’s tax / administrative court, which is called the Alabama Tax Tribunal. There are important deadlines in this phase of the process as well, such as 30 days to file in administrative court.

Settling an Alabama Sales Tax Liability

Along the way, you may have an opportunity to settle your Alabama sales tax case by negotiating with the Alabama Department of Revenue. Often, you can get better results here than with the auditor. If you or your professional team rarely does state and local tax work, it might be difficult to evaluate fair versus unreasonable sales tax settlement. We don’t recommend trying to negotiate a settlement without an experienced Alabama state and local tax lawyer or other professional.

Contest an Alabama Jeopardy Assessment

Alabama may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Alabama Department of Revenue accelerated rights and it may immediately begin to try and collect unpaid tax. Due to the jeopardy nature, the taxpayer only has a short period to contest the assessment and must generally place a security deposit to fight the issue.

Alabama Administrative Court

If you cannot resolve the case within the agency or missed available deadlines, you may still have one last chance to challenge your Alabama sales tax assessment by going to the Alabama Tax Tribunal. Because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

Once filed, the case proceeds to hearing and decision from a neutral Tribunal law judge. Our team has handled hundreds of administrative court cases and could help your company receive the resolution it wants. This appeal level is very similar to a regular court hearing and having an experienced representative is imperative because of the increased formality.

Other Alabama Sales Tax Resources

Reviews

-

"Jerry Provided Calming, Clear Guidance"

I can't say enough about Jerry and STH. We were in a bit of a panic re reaching nexus levels and dealing with reseller tax ...

- Mike L. -

"My Entire Experience Was Superior"

My entire experience from intake to resolution with Sales Tax Helper was superior. '11' on a scale of 1-10! Initial meeting ...

- Tim N. -

"Prompt, Courteous & Helpful!"

I sincerely am grateful for the prompt, courteous, and helpful that has been offered me by Sales Tax Helper. My agent, Alex ...

- Carol M. -

"Professional and Very Communicative"

When my business needed guidance with sales and use tax, I reached out to Sales Tax Helper through their website and received ...

- Pierce L. -

"They Are Experts in Their Field"

Jerry & Alex are excellent at what they do. They helped me navigate some very difficult and stressful situations. They’re ...

- Greg M. -

"Excellent Team to Work With!"

The team at Sales Tax Helper was excellent to work with. I had a complex business sales tax challenge that they methodically ...

- Mike M. -

"Always Provide Accurate & Prompt Responses"

Alex and Jerry always provide very accurate and prompt responses to my inquiries regarding the sales tax. They also bring ...

- Lukas P. -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O.